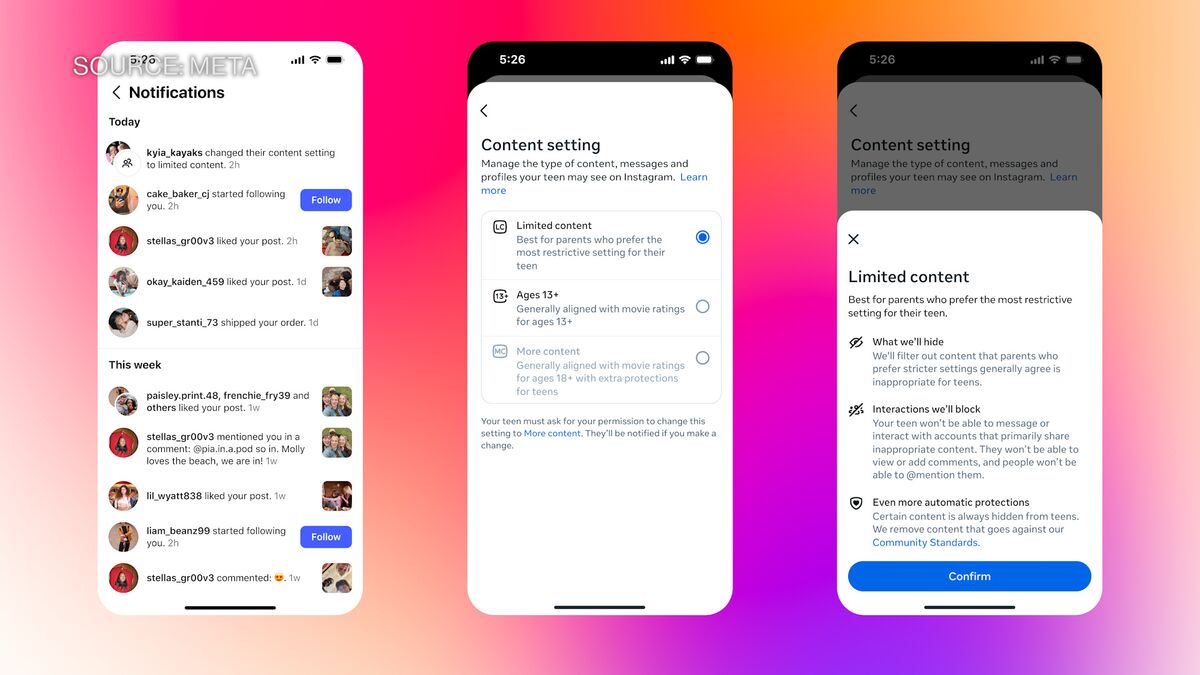

Instagram Follows Hollywood's 'PG-13' Footsteps

PositiveFinancial Markets

Instagram is taking a significant step towards protecting younger users by launching 'teen accounts' with stricter content settings for those under 18. Tara Hopkins, the Global Director of Policy at Instagram, shared insights on this initiative during her appearance on Bloomberg Tech. This move is crucial as it reflects the platform's commitment to creating a safer online environment for teens, aligning with broader industry trends towards responsible social media use.

— Curated by the World Pulse Now AI Editorial System