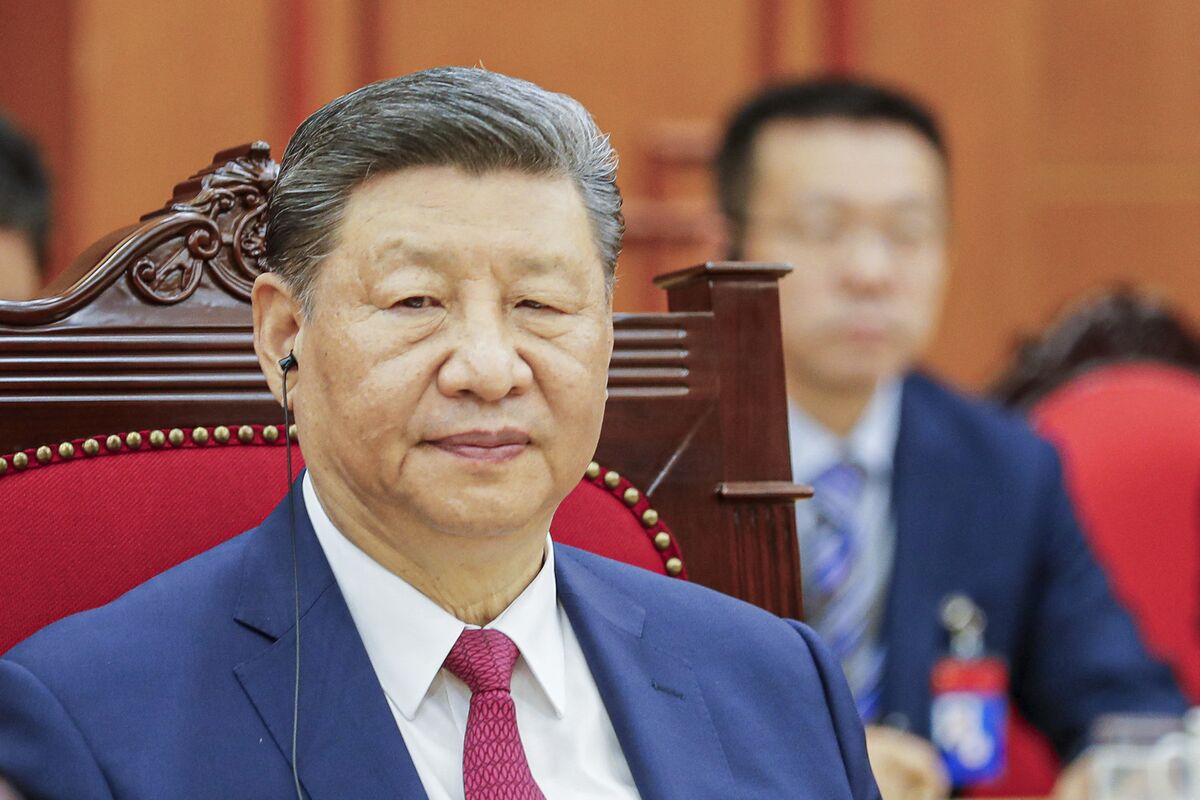

Xi Risks Global Blowback If China Curbs Rare Earths to Japan

NegativeFinancial Markets

- China has escalated its punitive actions against Japan, notably by reinstating a ban on Japanese seafood imports, following Prime Minister Sanae Takaichi's remarks about Taiwan's security implications. This move reflects ongoing tensions between the two nations.

- The suspension of seafood imports is significant for Japan's economy, particularly its seafood industry, which relies heavily on exports to China. The ban could exacerbate existing economic challenges for Japan amid rising diplomatic tensions.

- This situation highlights a broader pattern of economic retaliation in international relations, with Japan facing multiple pressures from China, including travel bans and market uncertainties, as both countries navigate their complex geopolitical landscape.

— via World Pulse Now AI Editorial System