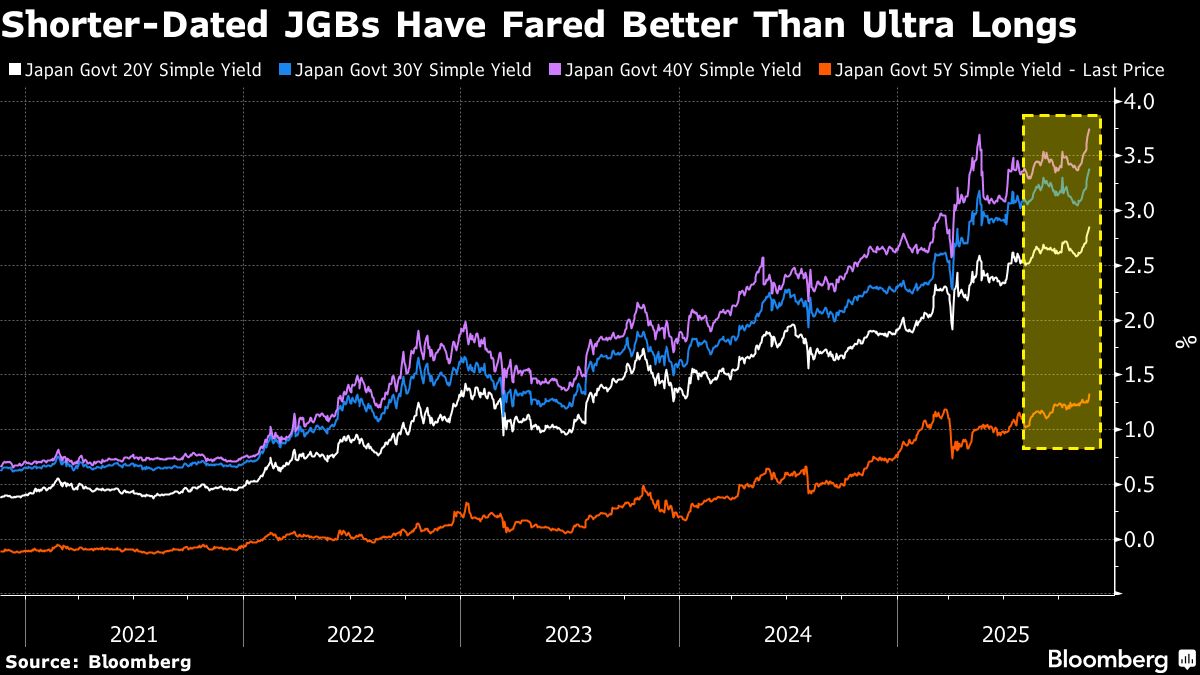

Bond Traders Probe Japan for Weakness at Belly of Yield Curve

NeutralFinancial Markets

- Bond traders are closely examining Japan's economic landscape as Prime Minister Sanae Takaichi prepares to unveil a significant stimulus package, which is expected to be the largest since the pandemic, valued at $135 billion.

- This stimulus is crucial for Takaichi's administration, as it aims to stabilize the economy amidst growing investor concerns and market volatility, particularly following recent declines in bond prices and the yen.

- The situation reflects broader economic anxieties in Japan, where recent stock market instability and rising bond yields have raised questions about the effectiveness of fiscal policies and the potential for further monetary easing.

— via World Pulse Now AI Editorial System