Why MP Materials is becoming America’s most critical rare-earth stock

PositiveFinancial Markets

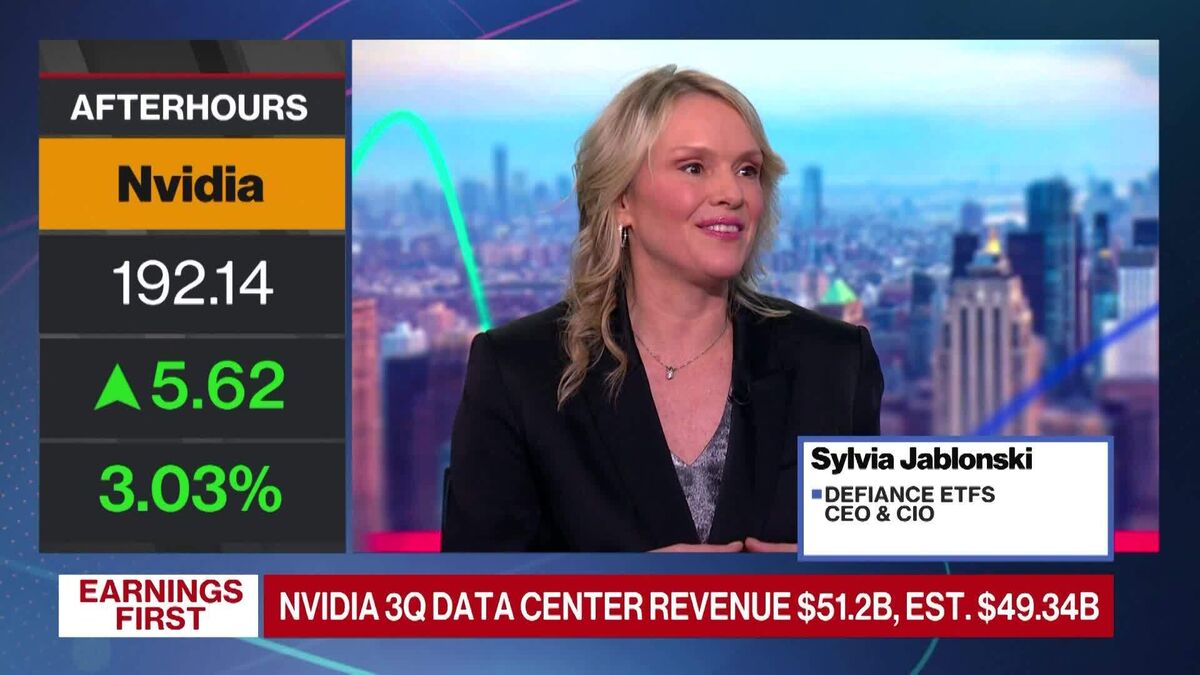

- MP Materials experienced an 8% increase in stock value on November 19, reflecting ongoing investor interest as geopolitical issues around rare earth minerals intensify and Nvidia's earnings loom.

- This surge in stock price highlights MP Materials' critical role in the rare earth market, particularly as demand for these minerals grows in technology sectors, including AI.

- The anticipation surrounding Nvidia's earnings is indicative of broader market concerns regarding the valuation of AI stocks, with investors wary of a potential bubble in the tech sector.

— via World Pulse Now AI Editorial System