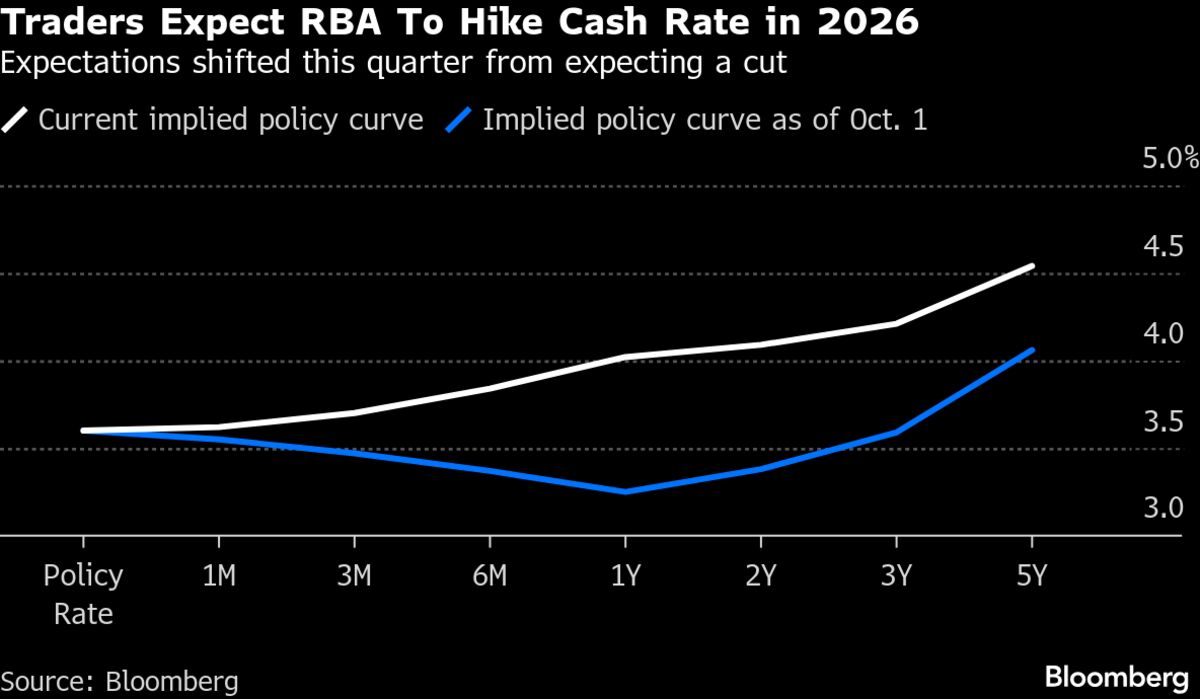

Australia central bank saw risk of rate rise in 2026 to contain inflation

NeutralFinancial Markets

- The Reserve Bank of Australia has acknowledged the potential for an interest rate increase in 2026 as a measure to combat rising inflation. This assessment comes amid ongoing economic pressures, with core inflation expected to remain above target levels until at least mid-2026.

- This development is significant as it indicates the central bank's proactive stance in managing inflationary risks, which could influence borrowing costs and consumer spending in the economy. Maintaining price stability is crucial for sustainable economic growth.

- The broader economic context reveals that Australia is not alone in facing inflation challenges, as similar trends are observed in other regions, including the Eurozone and Canada. Investors are adjusting their expectations for interest rates globally, reflecting a shift in monetary policy dynamics that could impact currency strength and international trade.

— via World Pulse Now AI Editorial System