Private Credit Riskier in Australia on Property Bets, CIOs Warn

NegativeFinancial Markets

- Private credit investments in Australia are increasingly viewed as risky, particularly due to their significant exposure to the property sector, according to warnings from some of the nation's largest funds. This trend raises concerns about the sustainability of such investments amid a volatile market landscape.

- The growing risk associated with private credit could impact investor confidence and the overall financial stability of funds heavily invested in real estate, potentially leading to broader economic implications.

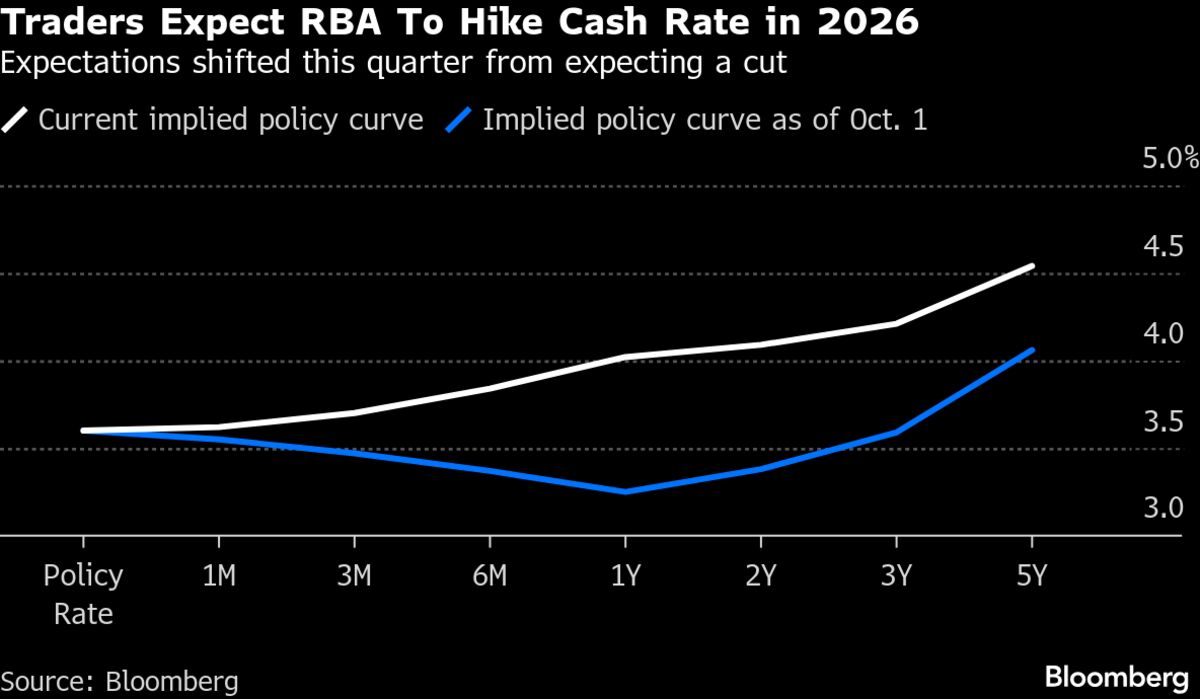

- This situation is compounded by declining consumer sentiment in Australia, driven by inflation and interest rate concerns, alongside regulatory challenges faced by the Australian Securities Exchange, which has raised alarms about its operational integrity.

— via World Pulse Now AI Editorial System