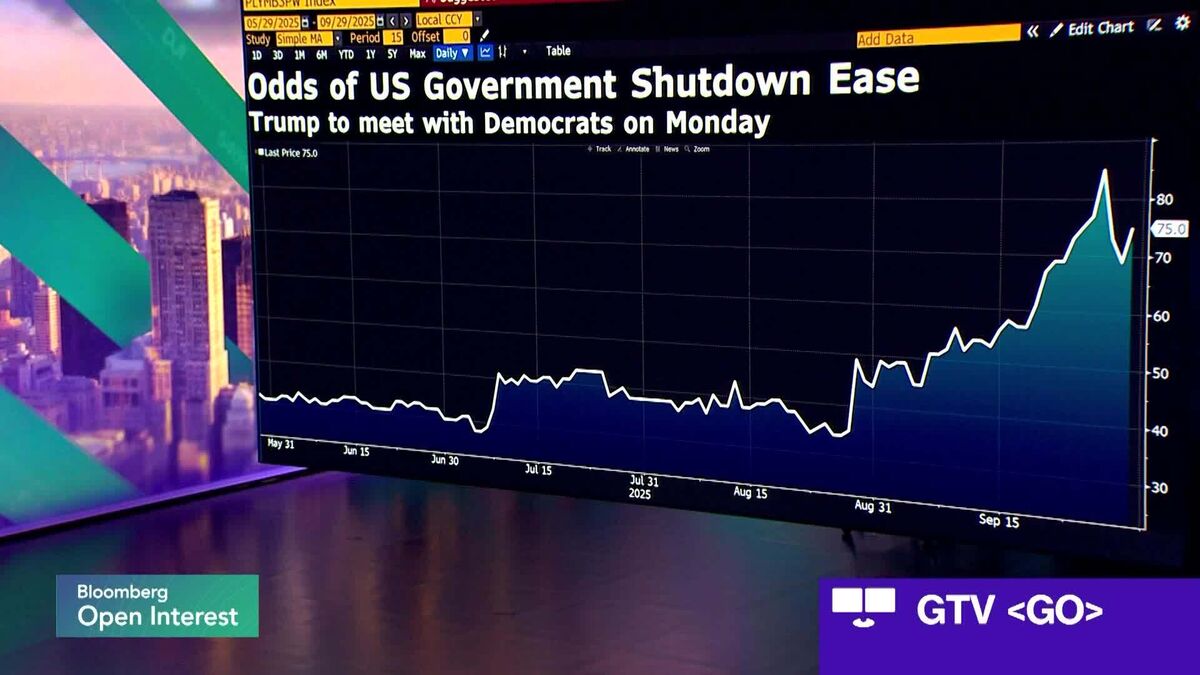

US Senate Democrats weighing short stopgap funding bill as alternative to government shutdown

NeutralFinancial Markets

US Senate Democrats are considering a short stopgap funding bill to prevent a government shutdown. This move is significant as it reflects the ongoing negotiations and challenges within Congress regarding budget allocations. By opting for a temporary solution, lawmakers aim to maintain government operations while they work on a more comprehensive budget plan, which is crucial for ensuring the continuity of public services and programs.

— Curated by the World Pulse Now AI Editorial System