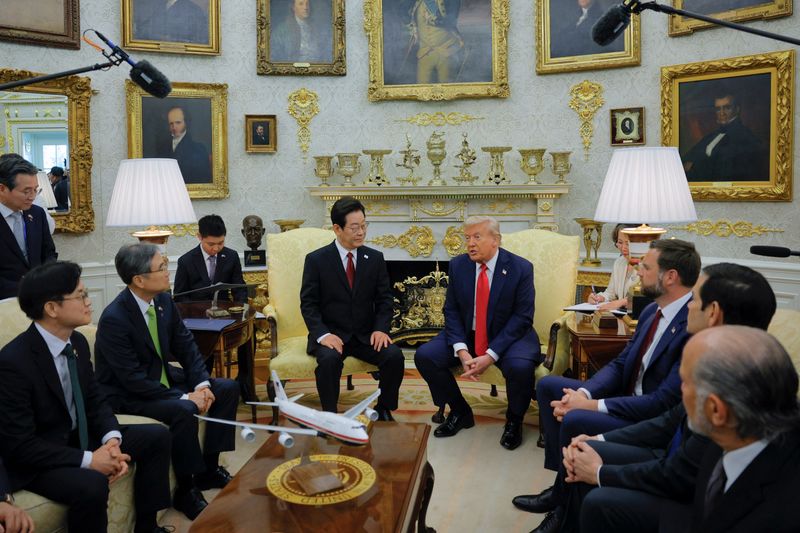

Analysis-South Korea’s booming used car exports cushion impact of US tariffs

PositiveFinancial Markets

South Korea's used car exports are thriving, providing a buffer against the impact of US tariffs on the automotive industry. This surge in exports not only highlights the resilience of South Korean manufacturers but also reflects a growing global demand for affordable vehicles. As the market adapts to changing trade dynamics, this trend could lead to increased economic stability and job creation within the country.

— Curated by the World Pulse Now AI Editorial System