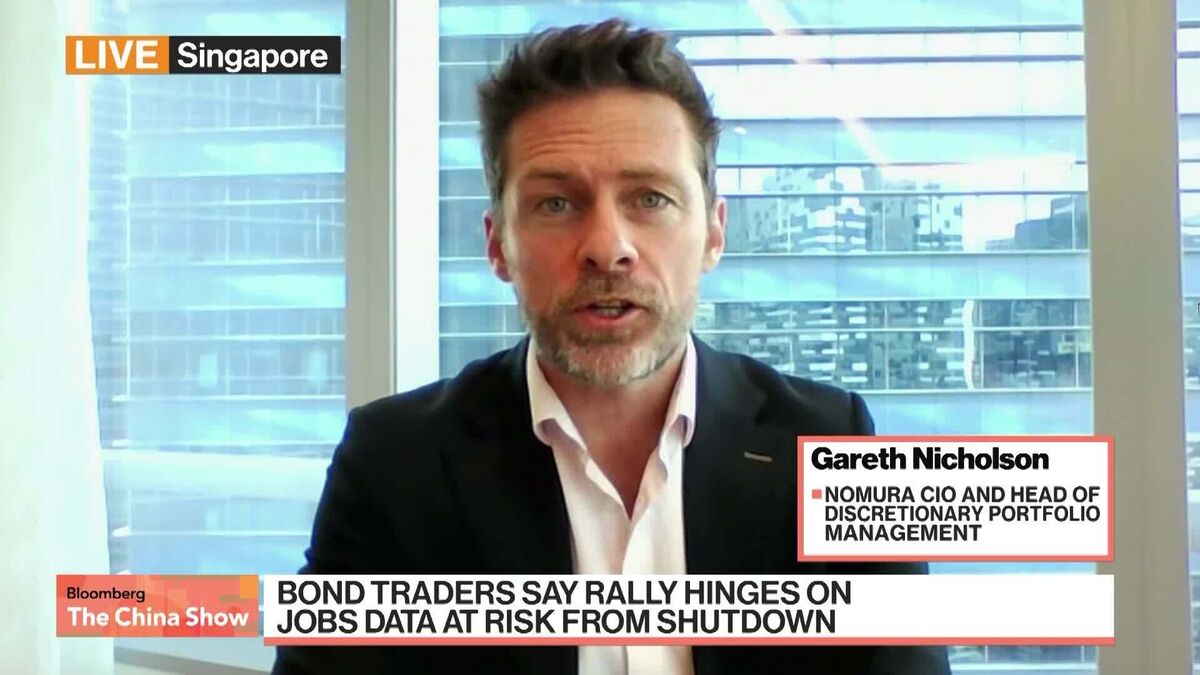

Weak Labor Market Fuel for Rally: Nomura's Nicholson

PositiveFinancial Markets

Gareth Nicholson, Nomura's CIO, suggests that a weak labor market might actually boost the stock market as it could lead the Federal Reserve to consider cutting interest rates. This perspective is particularly relevant as investors are also wary of a potential government shutdown, which could delay the release of crucial job data. Understanding these dynamics is essential for investors looking to navigate the current economic landscape.

— Curated by the World Pulse Now AI Editorial System