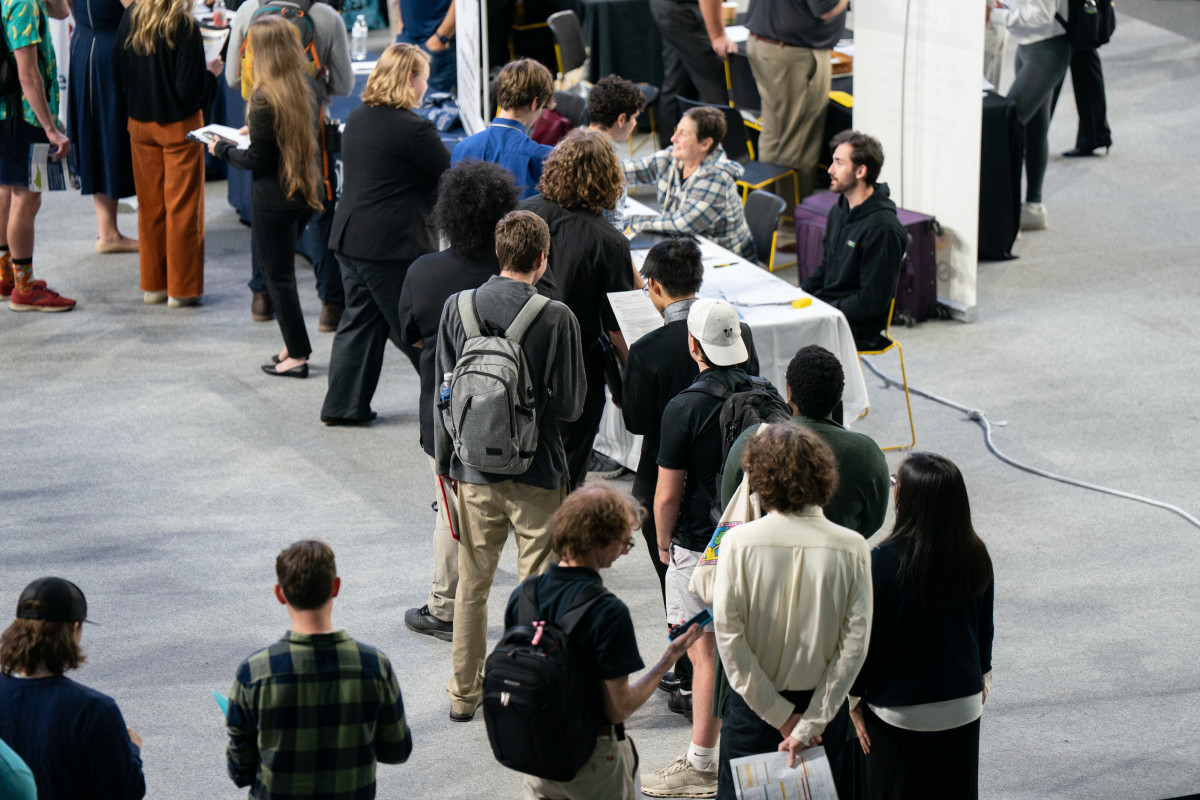

Soaring student loans are weighing on the economy

NegativeFinancial Markets

The rising burden of student loans is increasingly impacting the economy, contributing to a surge in consumer bankruptcies. As more individuals struggle to manage their debt, the financial landscape is becoming more precarious, which could lead to larger economic challenges ahead. This situation matters because it highlights the urgent need for reforms in the student loan system to alleviate financial pressure on borrowers.

— Curated by the World Pulse Now AI Editorial System