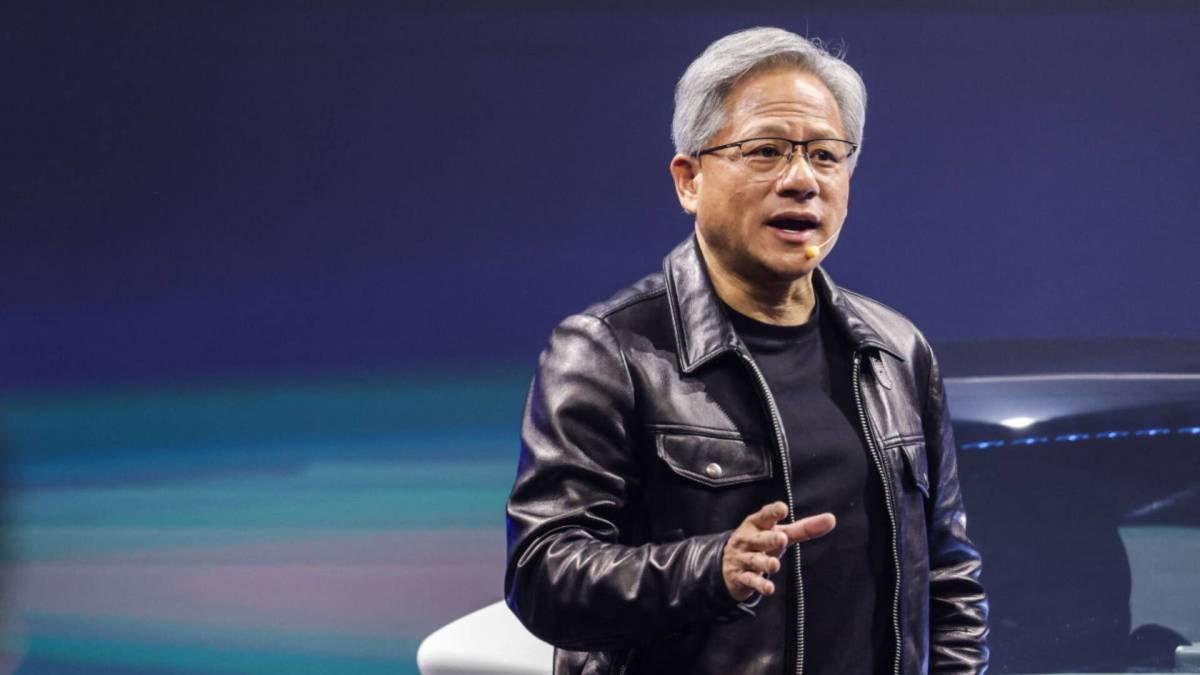

Top Stock Movers: Nividia Slips, Halliburton and BigBear Ai soars

NeutralFinancial Markets

Today's stock market saw notable movements, with Nvidia experiencing a decline while Halliburton and BigBear AI saw significant gains. This fluctuation in stock prices highlights the dynamic nature of the market and can impact investor decisions and market trends.

— Curated by the World Pulse Now AI Editorial System