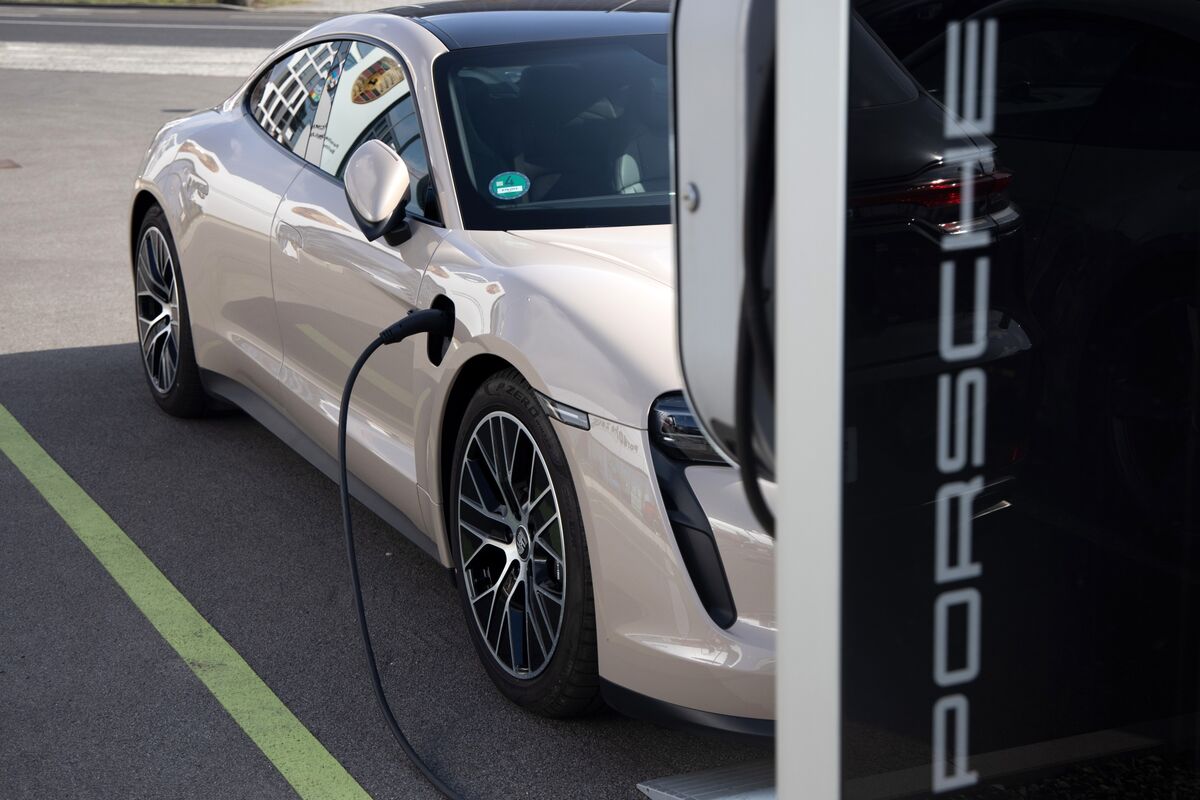

Porsche shares plunge after delayed EV launch hits guidance

NegativeFinancial Markets

Porsche's shares have taken a significant hit following the announcement of a delayed electric vehicle (EV) launch, which has led the company to revise its financial guidance downward. This news is particularly concerning as it highlights the challenges traditional automakers face in transitioning to electric models, a crucial step in the industry’s future. Investors are reacting negatively, reflecting worries about Porsche's ability to compete in the rapidly evolving EV market.

— Curated by the World Pulse Now AI Editorial System