Turkey Investors Await Court Verdict on Main Opposition Party

NeutralFinancial Markets

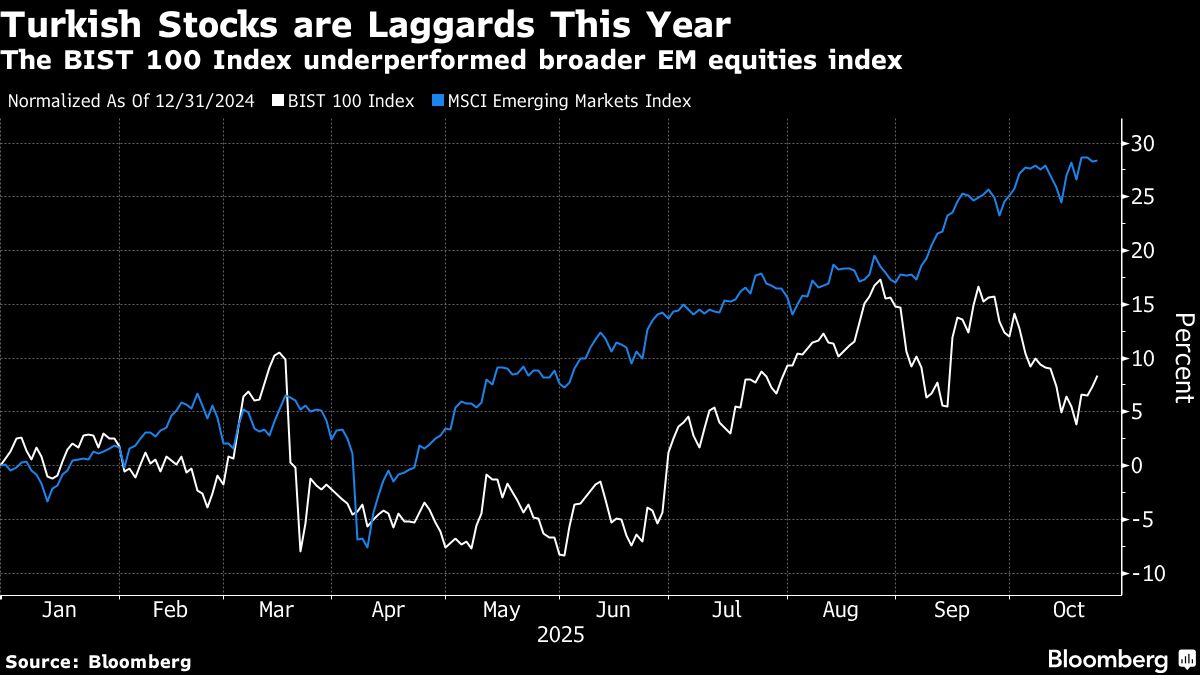

Investors in Turkey are closely monitoring an upcoming court verdict regarding the main opposition party, which is set to be announced on Friday. This decision could significantly impact the political landscape and potentially heighten tensions within the country. Understanding the outcome is crucial for investors as it may influence market stability and the overall economic environment.

— Curated by the World Pulse Now AI Editorial System