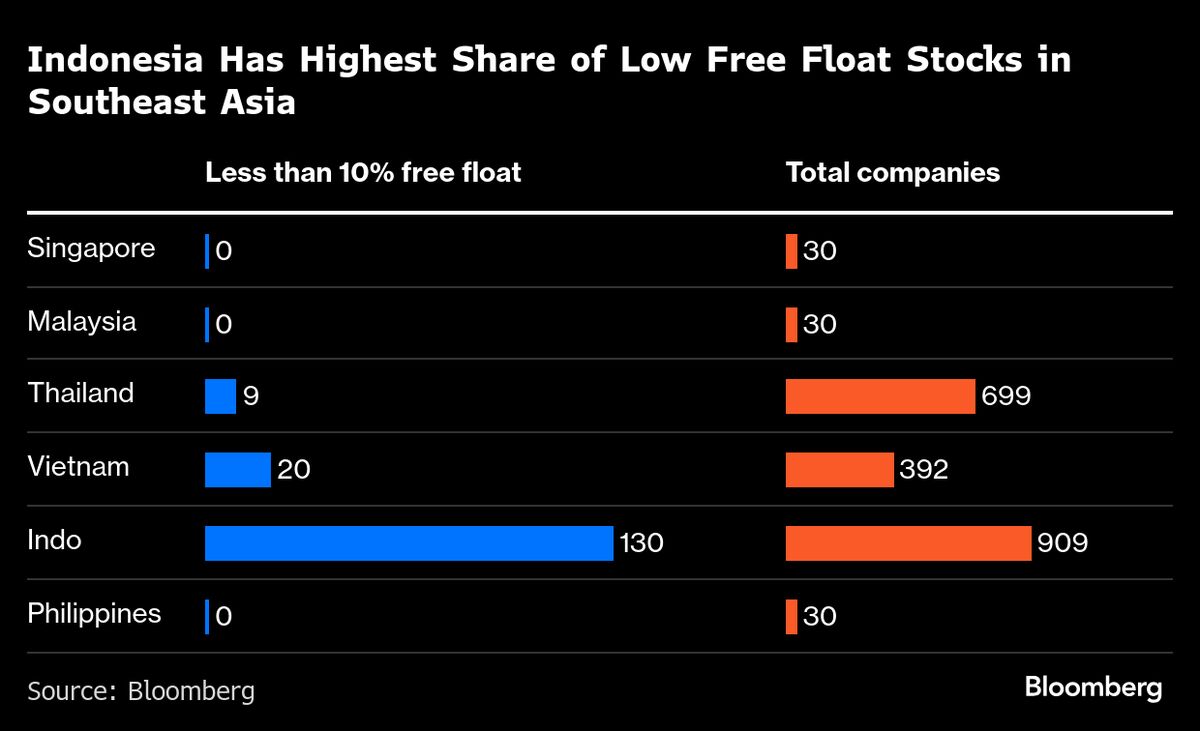

MSCI’s Eye on Low-Free-Float Indonesian Stocks May Spur Outflows

NegativeFinancial Markets

Indonesian stocks could face significant outflows as Citigroup warns that MSCI is considering adjustments to its index weightings based on specific shareholding structures. This news is crucial as it highlights potential vulnerabilities in the Indonesian market, which could lead to decreased investor confidence and impact the overall economy.

— Curated by the World Pulse Now AI Editorial System