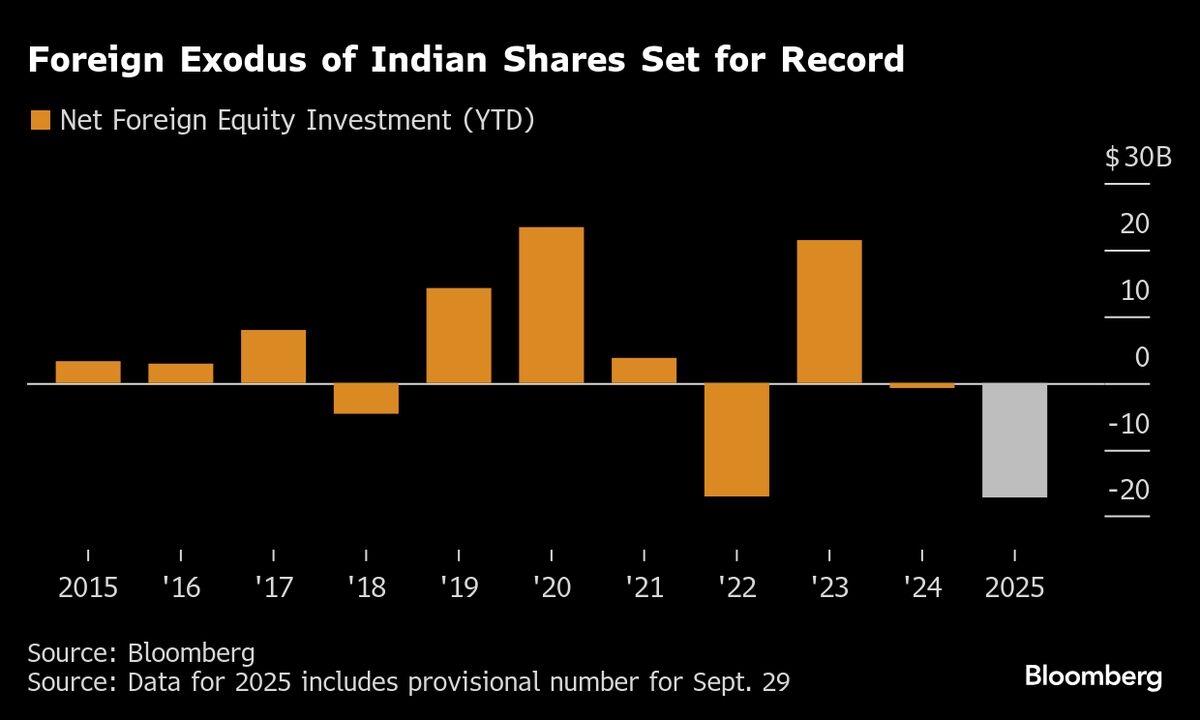

Foreign Investors Are Ditching Indian Stocks Faster Than Ever

NegativeFinancial Markets

Indian stocks are facing unprecedented foreign outflows this year, driven by rising concerns over US tariffs and disappointing earnings reports. This trend is significant as it reflects growing apprehension among investors about the Indian market's stability and future growth potential, which could have broader implications for the economy.

— Curated by the World Pulse Now AI Editorial System