Exclusive-OPEC+ plans another oil output hike in November, sources say

PositiveFinancial Markets

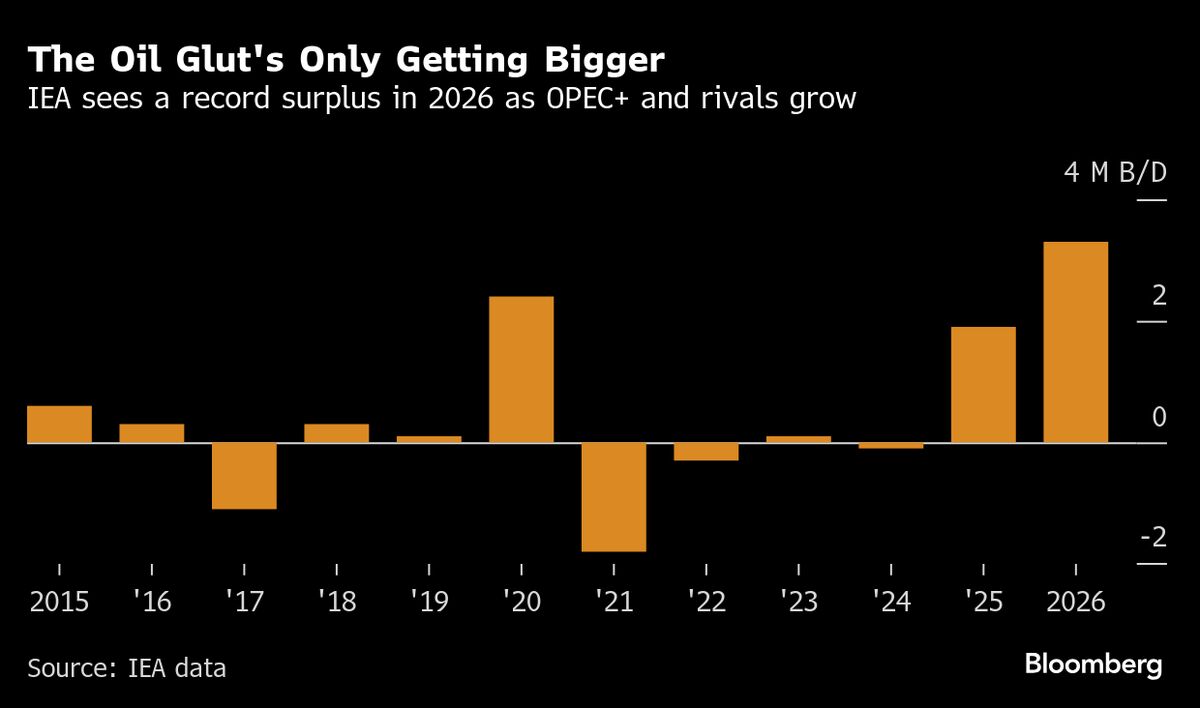

OPEC+ is reportedly planning another increase in oil output for November, which could have significant implications for global oil prices and energy markets. This move is seen as a response to rising demand and aims to stabilize the market, benefiting both producers and consumers. As economies recover post-pandemic, this decision reflects OPEC+'s strategy to balance supply and demand, ensuring a steady flow of oil while potentially boosting revenues for member countries.

— Curated by the World Pulse Now AI Editorial System