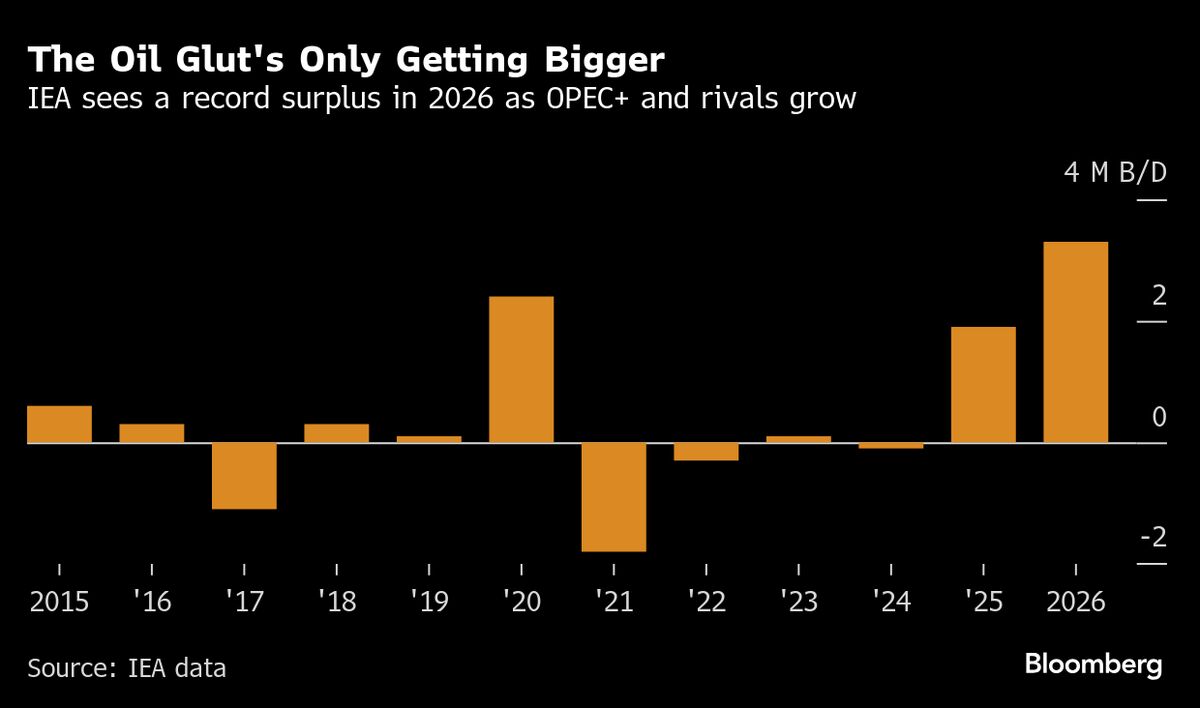

OPEC+ Seen Likely to Approve Another Output Hike for November

PositiveFinancial Markets

OPEC+ is expected to approve another increase in oil output for November, signaling its commitment to reclaiming global market share. This move is significant as it reflects the group's ongoing strategy to adapt to changing market dynamics and could impact global oil prices and supply.

— Curated by the World Pulse Now AI Editorial System