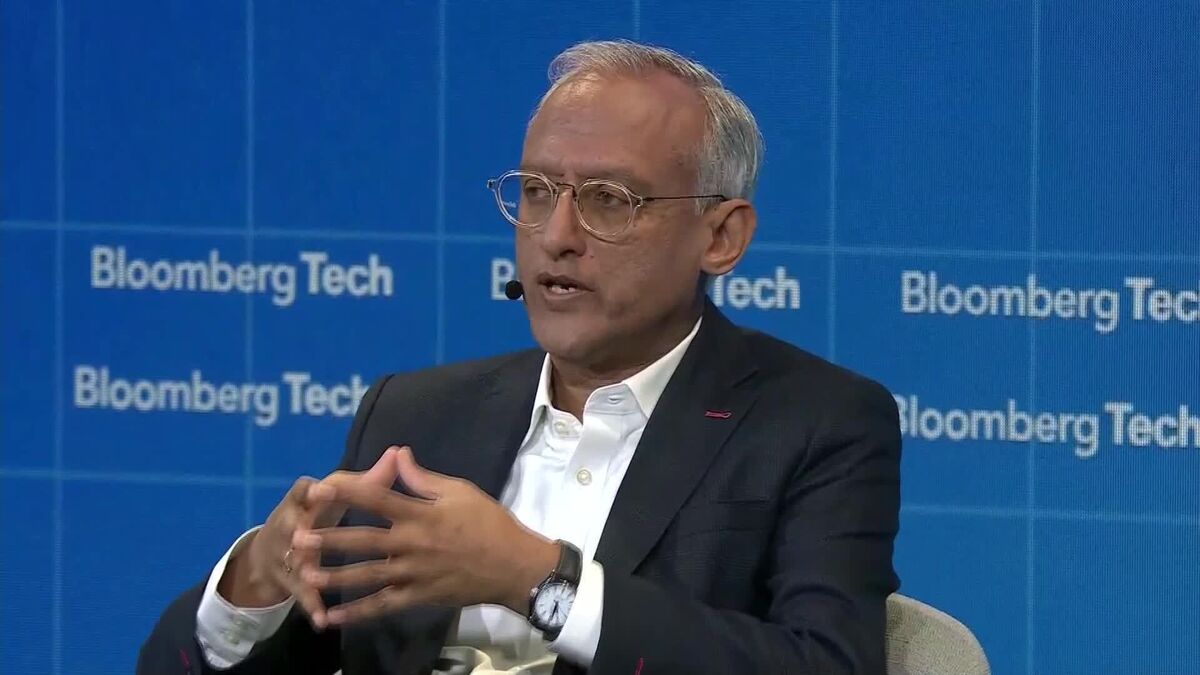

David Herro Worries Market Mania in the Making

NegativeFinancial Markets

David Herro, the CIO of Oakmark, has expressed concerns about a potential market mania driven by AI investments. He warns that while these technologies are revolutionary, investors may be overlooking their limitations in pursuit of quick gains. This perspective is crucial as it highlights the risks of speculative investing, reminding us that not all technological advancements guarantee sustainable returns.

— Curated by the World Pulse Now AI Editorial System