Private Credit Faces Dispersion, Not Crisis: :Reynolds

PositiveFinancial Markets

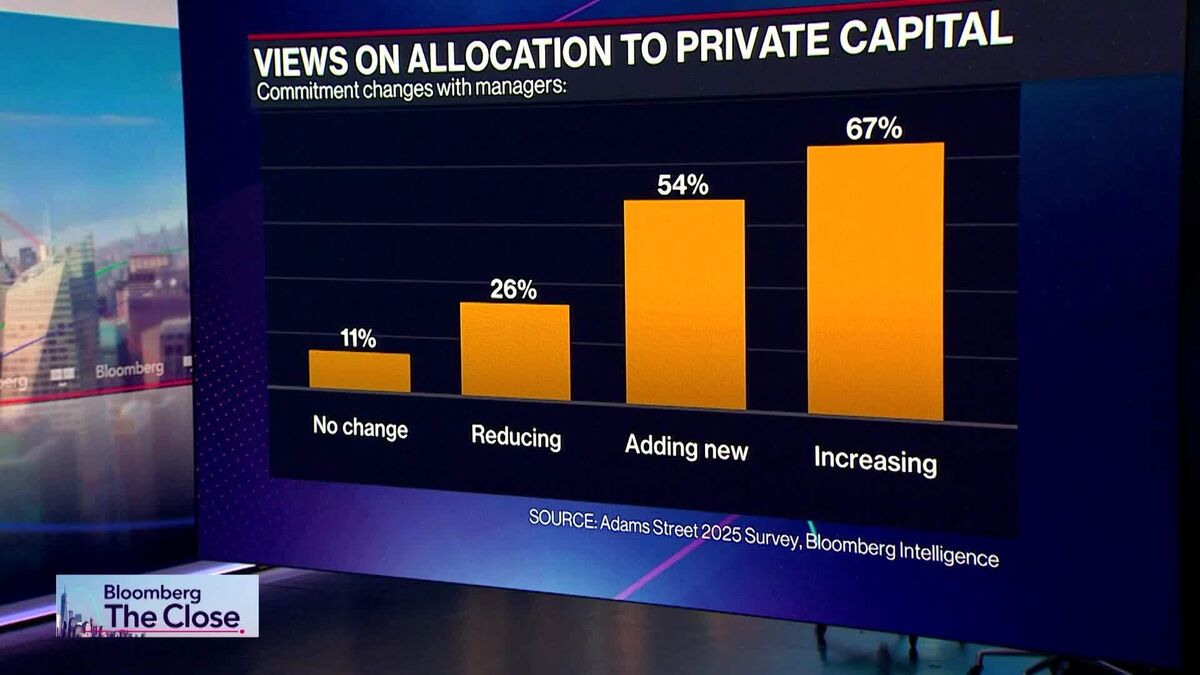

Private credit is evolving rather than facing a crisis, according to James Reynolds from Goldman Sachs Asset Management. He emphasizes that while future returns may vary due to increased competition and less experienced players entering the market, established firms with strong foundations will continue to thrive. This insight is crucial for investors as it highlights the importance of discipline and selectivity in navigating the changing landscape of private credit.

— Curated by the World Pulse Now AI Editorial System