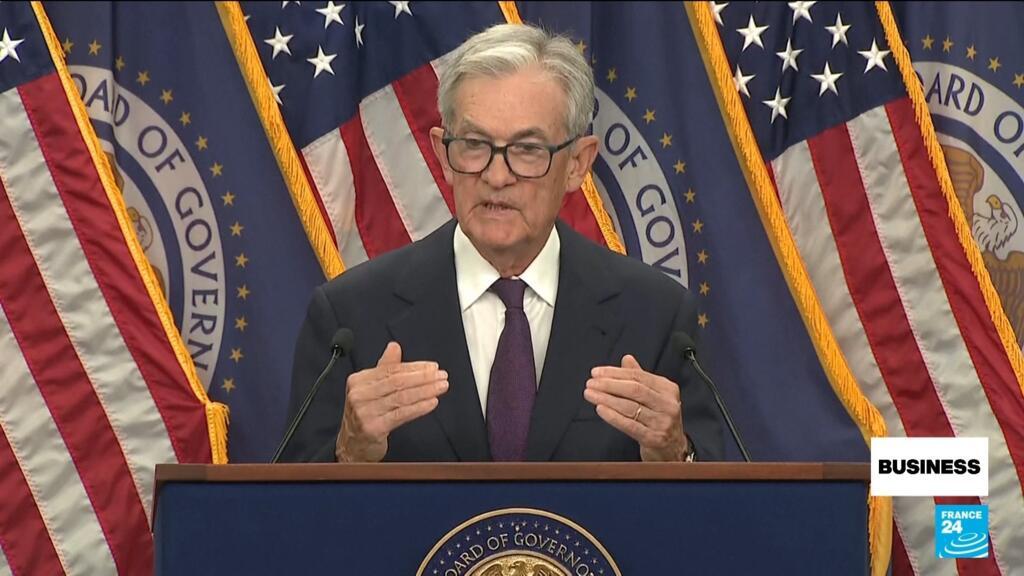

US Federal Reserve cuts interest rates for first time in nine months

NeutralFinancial Markets

The US Federal Reserve has made a significant move by cutting interest rates for the first time in nine months, now setting the benchmark rate between 4.00 and 4.25 percent. This decision, supported by nearly all members of the monetary policy committee, reflects ongoing economic considerations. Meanwhile, in a separate development, Jerry Greenfield, co-founder of Ben & Jerry’s, has resigned, claiming that Unilever, the parent company, is stifling the brand's commitment to social activism. These events are crucial as they highlight shifts in economic policy and corporate governance.

— Curated by the World Pulse Now AI Editorial System