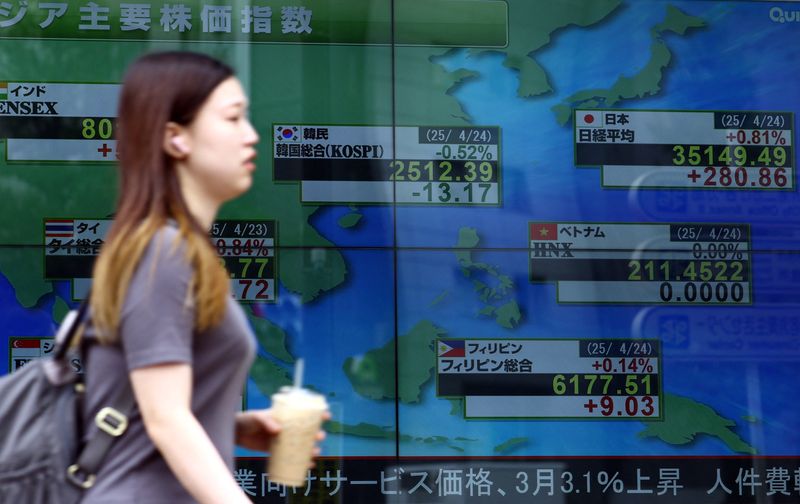

Asia stocks rise on tech gains as RBA meeting looms; Japan lags

PositiveFinancial Markets

Asian stocks are experiencing a positive surge, driven by gains in the technology sector, as investors eagerly await the upcoming Reserve Bank of Australia meeting. This rise reflects growing confidence in the market, particularly in tech stocks, which have shown resilience and potential for growth. However, Japan's market is lagging behind, highlighting regional disparities in economic recovery. The outcome of the RBA meeting could further influence market trends, making this an important moment for investors.

— Curated by the World Pulse Now AI Editorial System