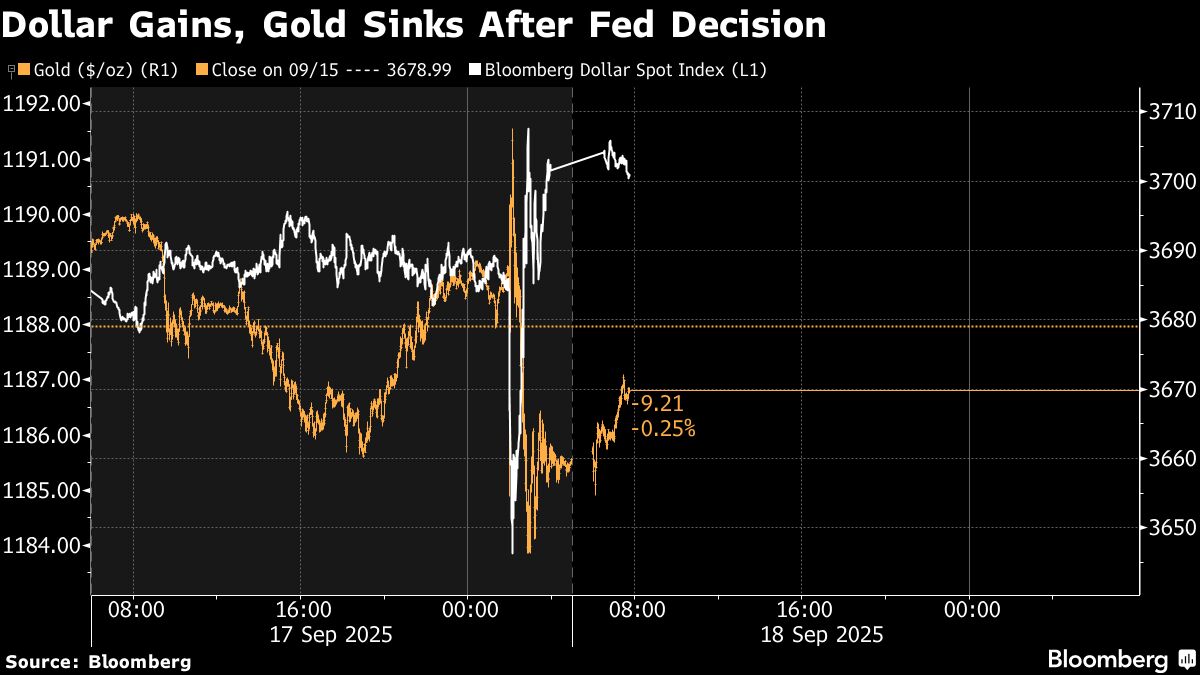

Fed’s Powell explains how central bank moderate rates mandate works

NeutralFinancial Markets

Federal Reserve Chair Jerome Powell recently clarified how the central bank's mandate to moderate interest rates operates. This explanation is crucial as it sheds light on the Fed's approach to balancing economic growth and inflation control, which directly impacts consumers and businesses alike. Understanding these mechanisms helps the public grasp the complexities of monetary policy and its effects on the economy.

— Curated by the World Pulse Now AI Editorial System