India Poised for Biggest-Ever IPO Month With $5 Billion in Deals

PositiveFinancial Markets

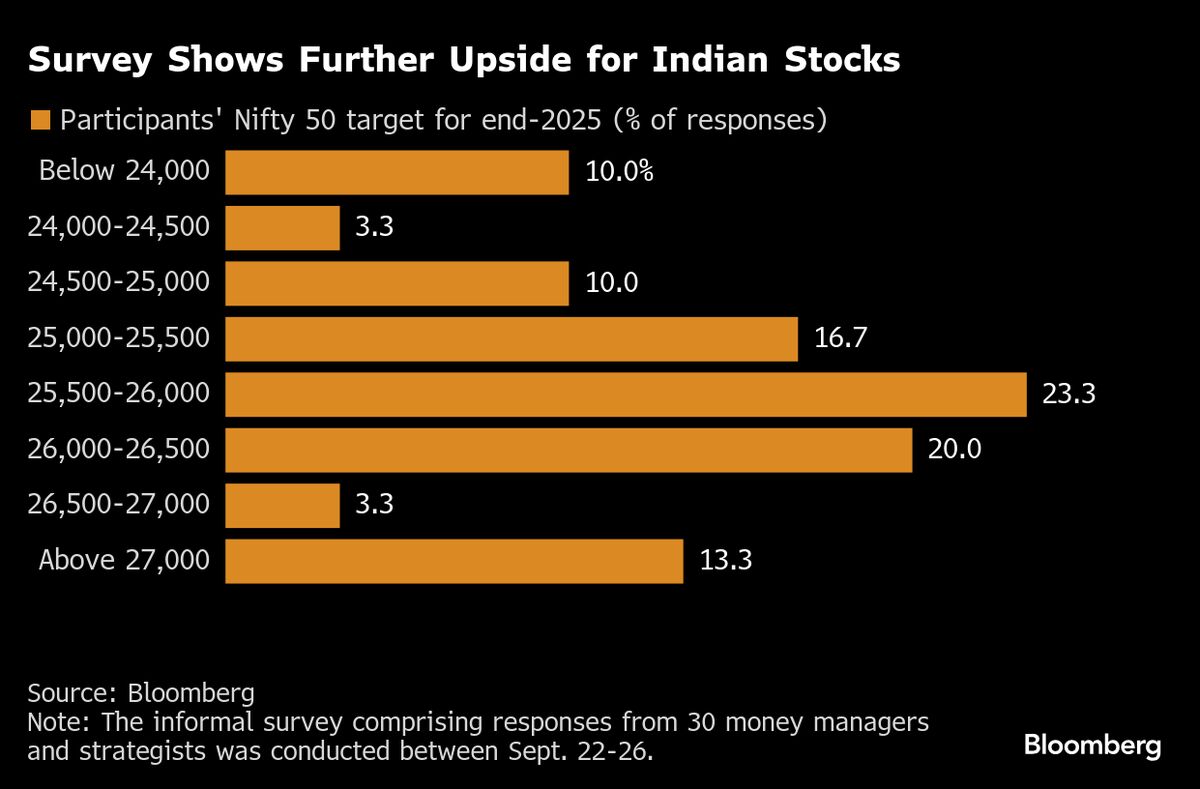

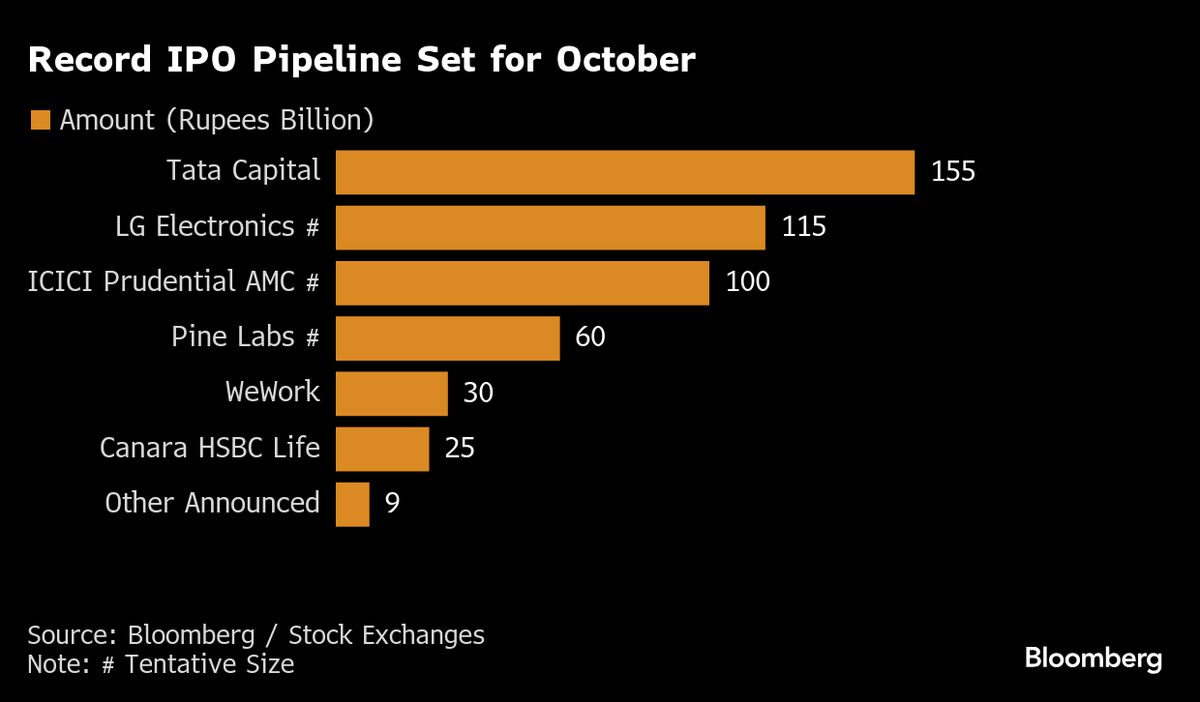

India is gearing up for its biggest month of initial public offerings (IPOs) ever, with companies projected to raise over $5 billion in October. This surge reflects a robust investor appetite in one of the world's most active equity markets, showcasing the confidence in India's economic growth and potential. Such a record-setting month not only highlights the vibrancy of the Indian market but also attracts global attention, making it a significant event for investors and companies alike.

— Curated by the World Pulse Now AI Editorial System