Cybersecurity firm Netskope raises $908.2 million in US IPO

PositiveFinancial Markets

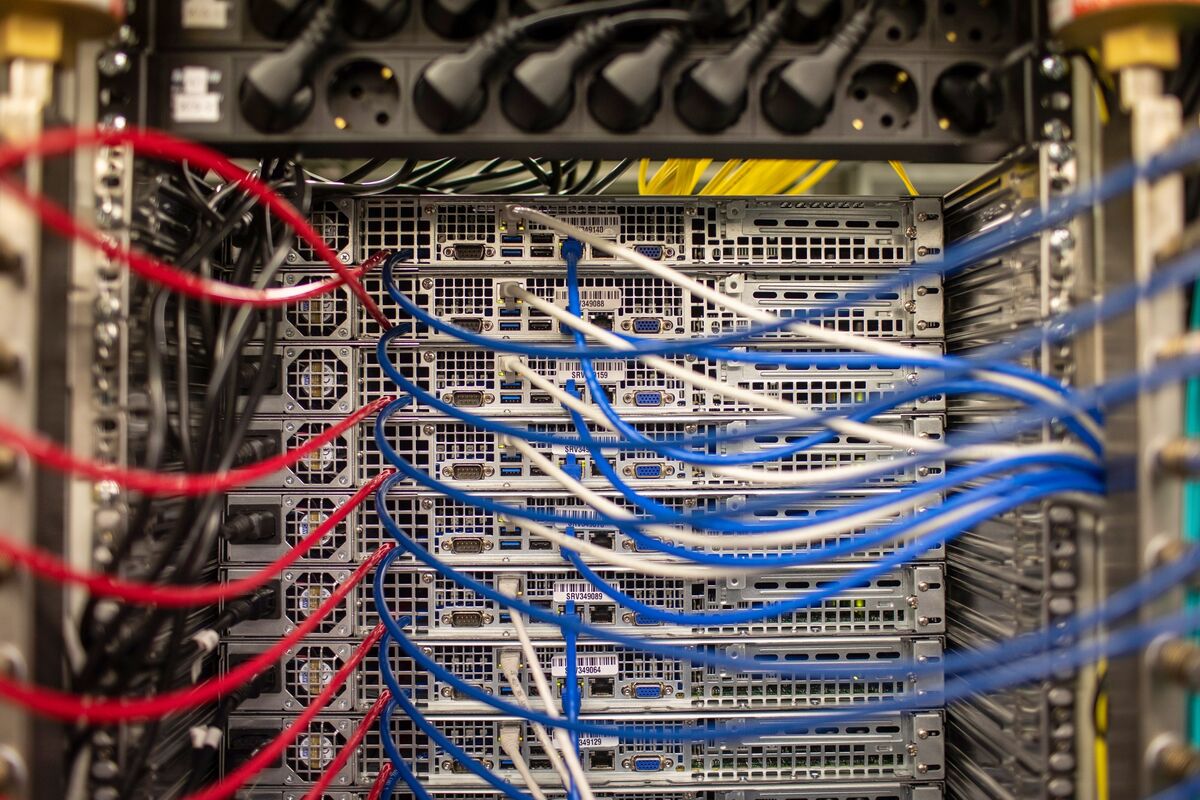

Netskope, a leading cybersecurity firm, has successfully raised $908.2 million in its initial public offering (IPO) in the United States. This significant funding not only highlights the growing demand for cybersecurity solutions but also positions Netskope as a key player in the tech industry. The influx of capital will enable the company to expand its services and innovate further, which is crucial as businesses increasingly prioritize digital security.

— Curated by the World Pulse Now AI Editorial System