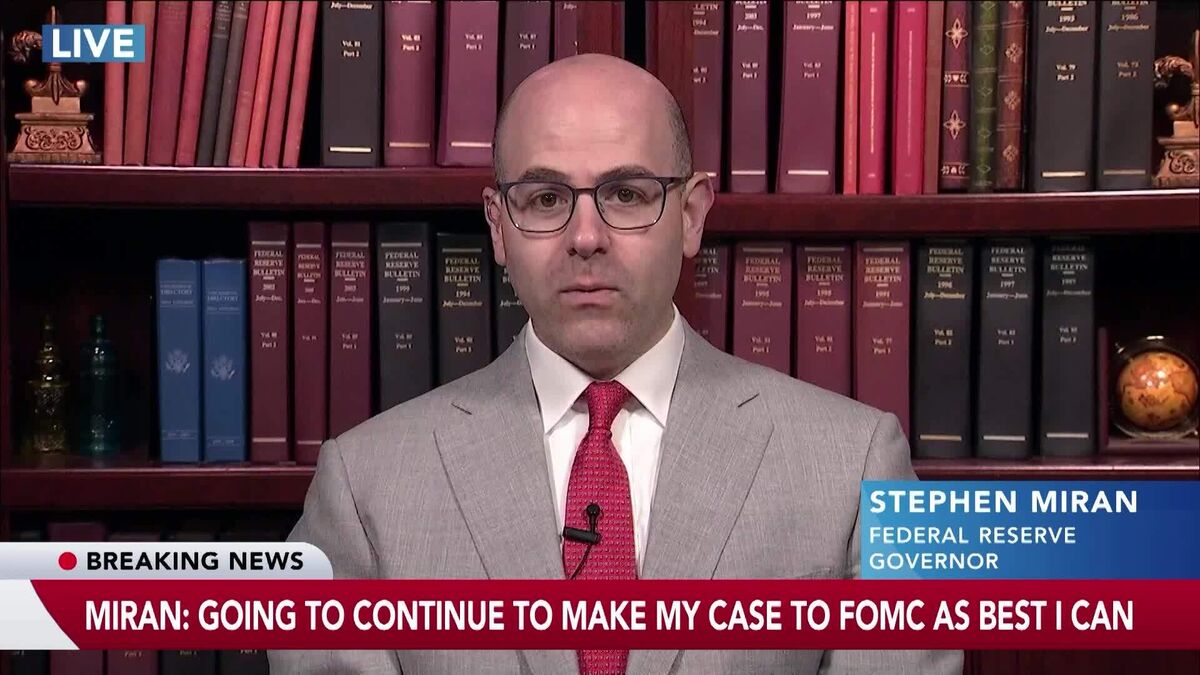

Morning Bid: More Fedspeak, more questions

NeutralFinancial Markets

In today's financial landscape, the Federal Reserve's ongoing discussions are raising more questions than answers. As officials speak on interest rates and inflation, investors are left to navigate the uncertainty surrounding the economy and market reactions. Understanding these developments is crucial for anyone looking to make informed financial decisions.

— Curated by the World Pulse Now AI Editorial System