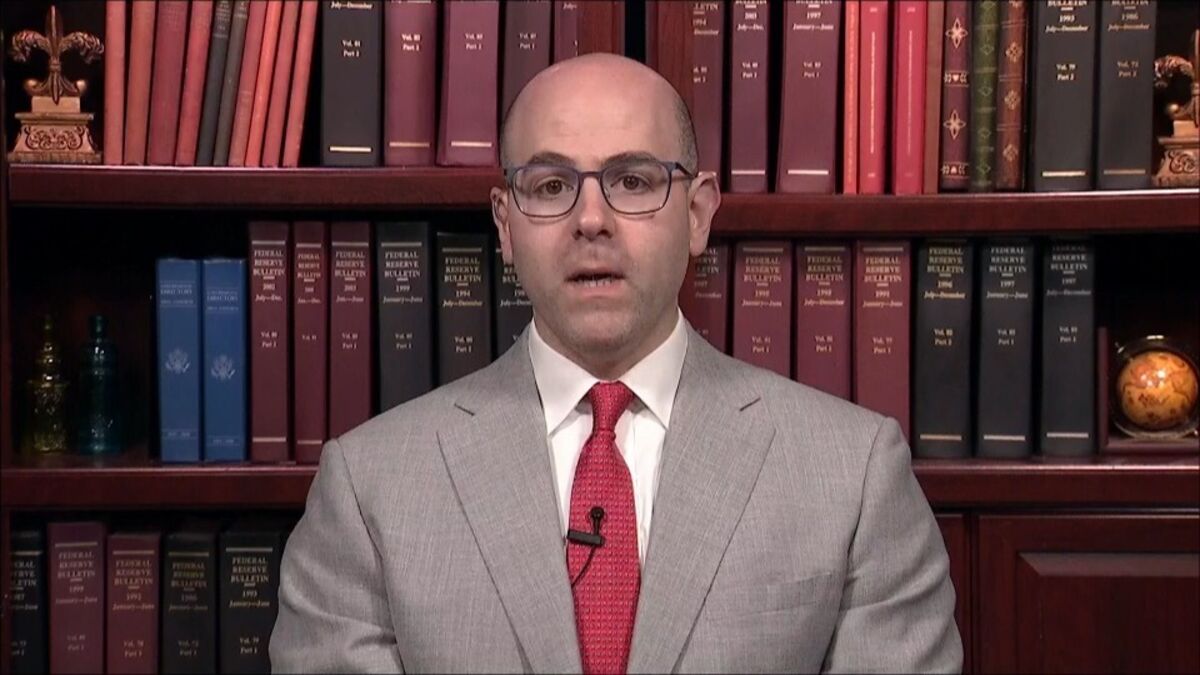

Treasury Yields Climb to Three-Week High Before Fed Speakers

NeutralFinancial Markets

Treasury yields have reached a three-week high as investors await important US economic data and insights from Federal Reserve officials regarding future interest rates. This development is significant as it reflects market reactions to economic indicators and central bank communications, which can influence investment strategies and economic forecasts.

— Curated by the World Pulse Now AI Editorial System