Major analyst drops 5-word take on market pullback

NeutralFinancial Markets

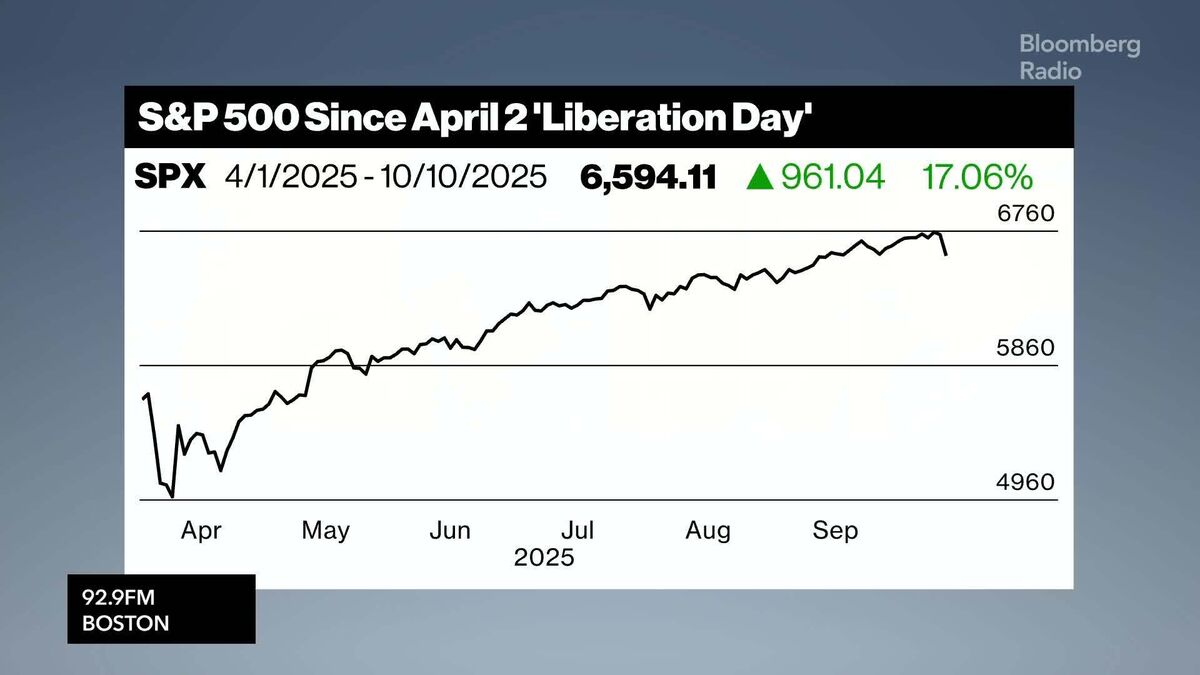

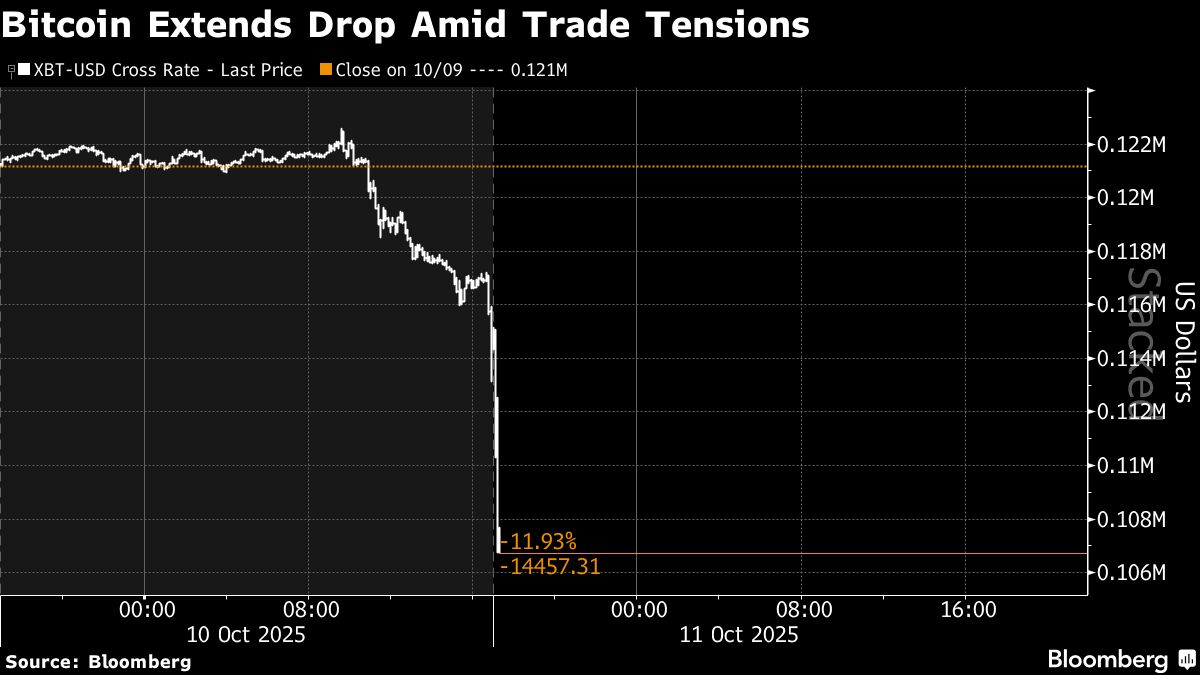

On October 10, the stock market experienced a significant pullback, prompting traders to react swiftly as screens turned red. This volatility highlights the unpredictable nature of the market, especially under the leadership of President Donald Trump, where conditions can change rapidly. Understanding these fluctuations is crucial for investors as they navigate potential buying opportunities amidst uncertainty.

— Curated by the World Pulse Now AI Editorial System