Stock Market Today: Gold Suffers Biggest Drop in More Than a Decade

NegativeFinancial Markets

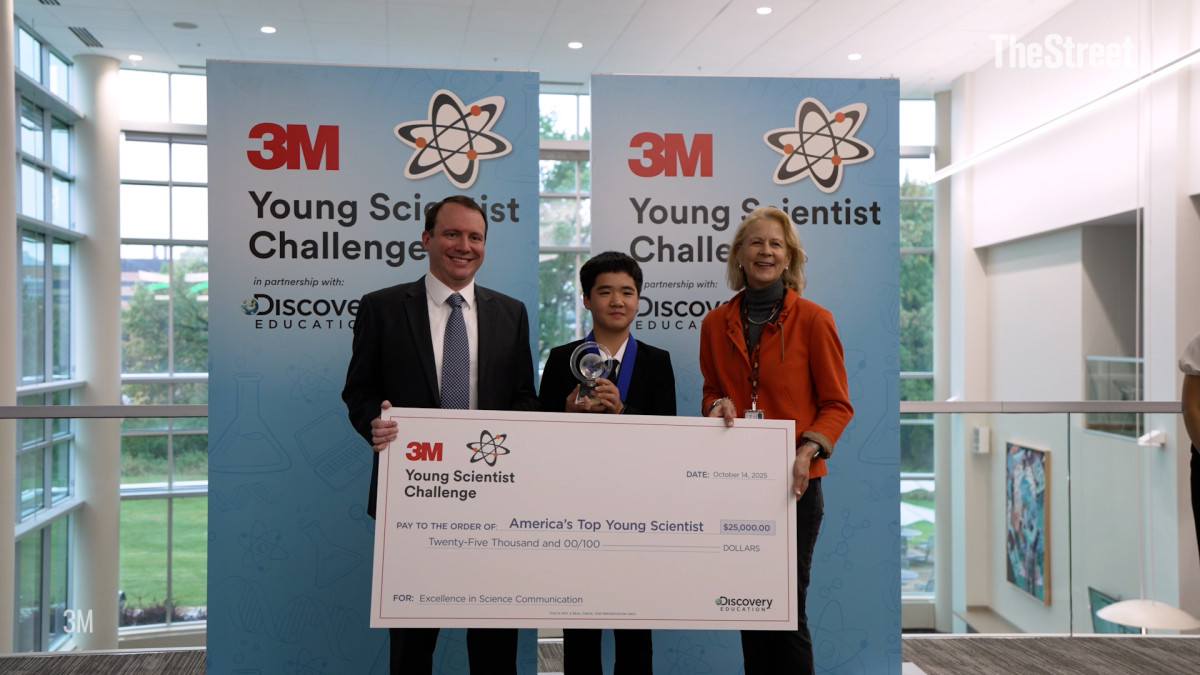

Today, the stock market experienced a mixed bag of results. While the Dow industrials reached a record high, gold prices took a significant hit, marking the biggest drop in over a decade. This decline in gold is noteworthy as it reflects changing investor sentiments and market dynamics. Meanwhile, shares in General Motors and 3M saw a rally following positive earnings results, indicating that some sectors are thriving despite the overall volatility. Understanding these trends is crucial for investors looking to navigate the current economic landscape.

— Curated by the World Pulse Now AI Editorial System