Big Tech tests investors’ patience with $80bn AI investment spree

NeutralFinancial Markets

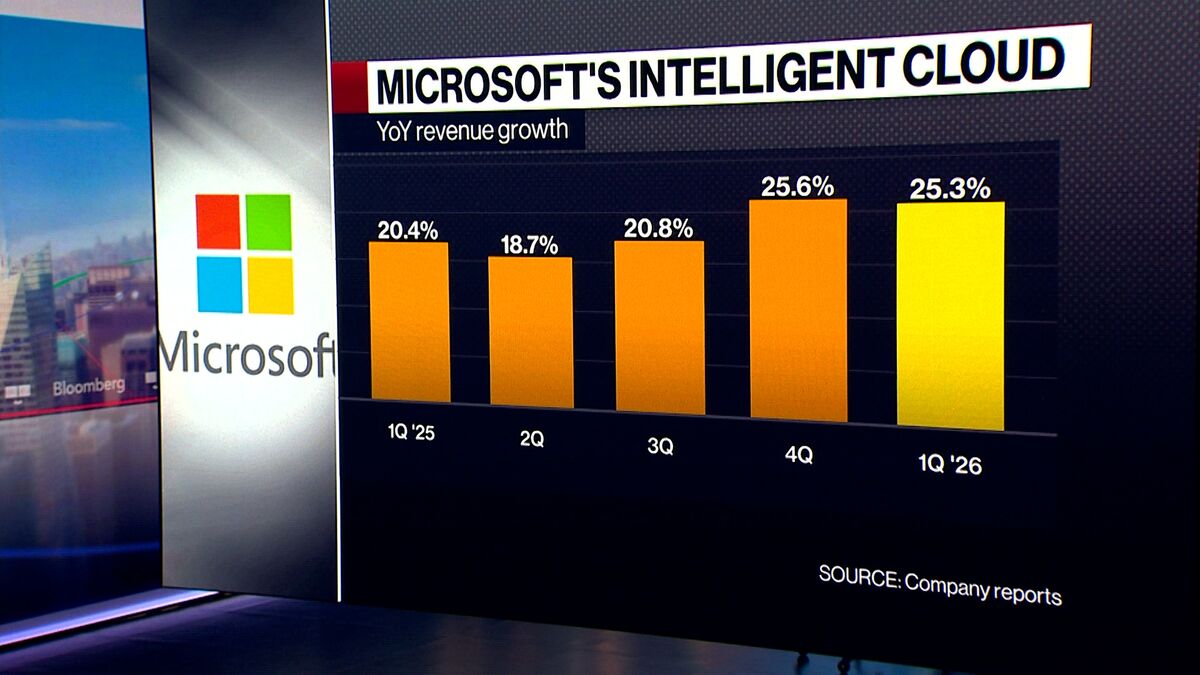

Big Tech companies like Alphabet, Meta, and Microsoft are making headlines with their massive $80 billion investment in artificial intelligence. This bold move has sparked a debate among investors about whether these companies can effectively turn such significant capital expenditures into profitable income. As the tech landscape evolves, the outcome of these investments could reshape the market and influence future trends in AI development.

— Curated by the World Pulse Now AI Editorial System