Goldman Clients Take More ‘Cautious Posture’ After November Rout

NegativeFinancial Markets

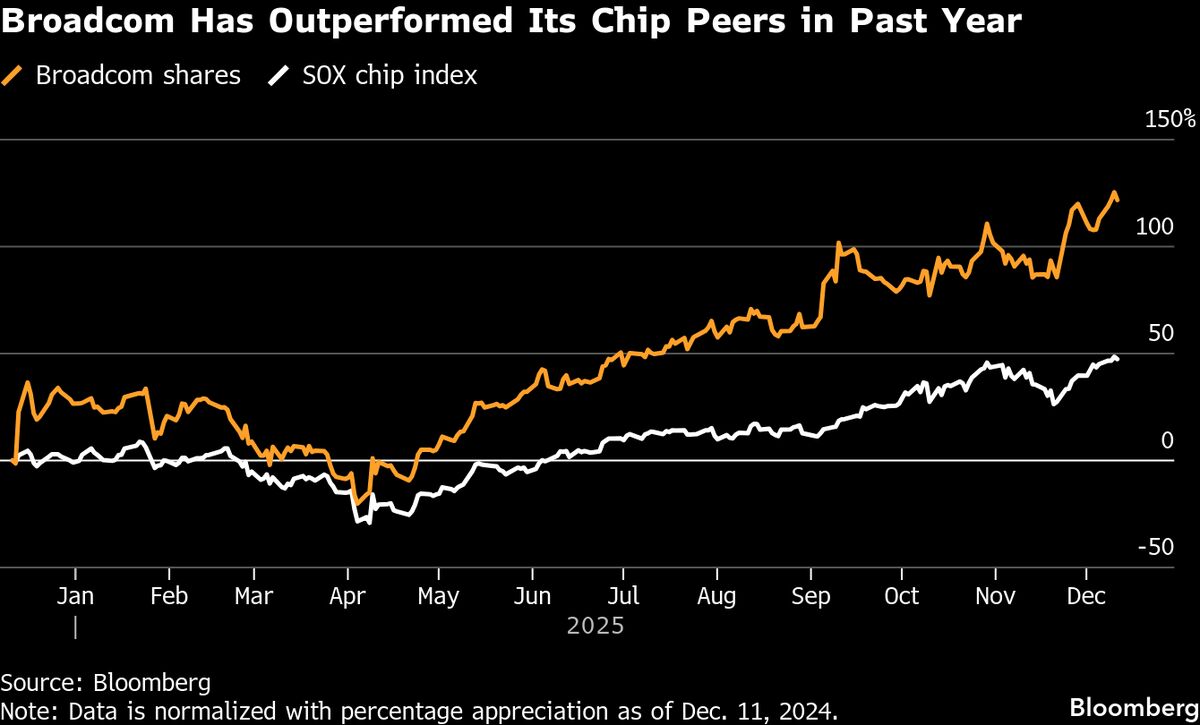

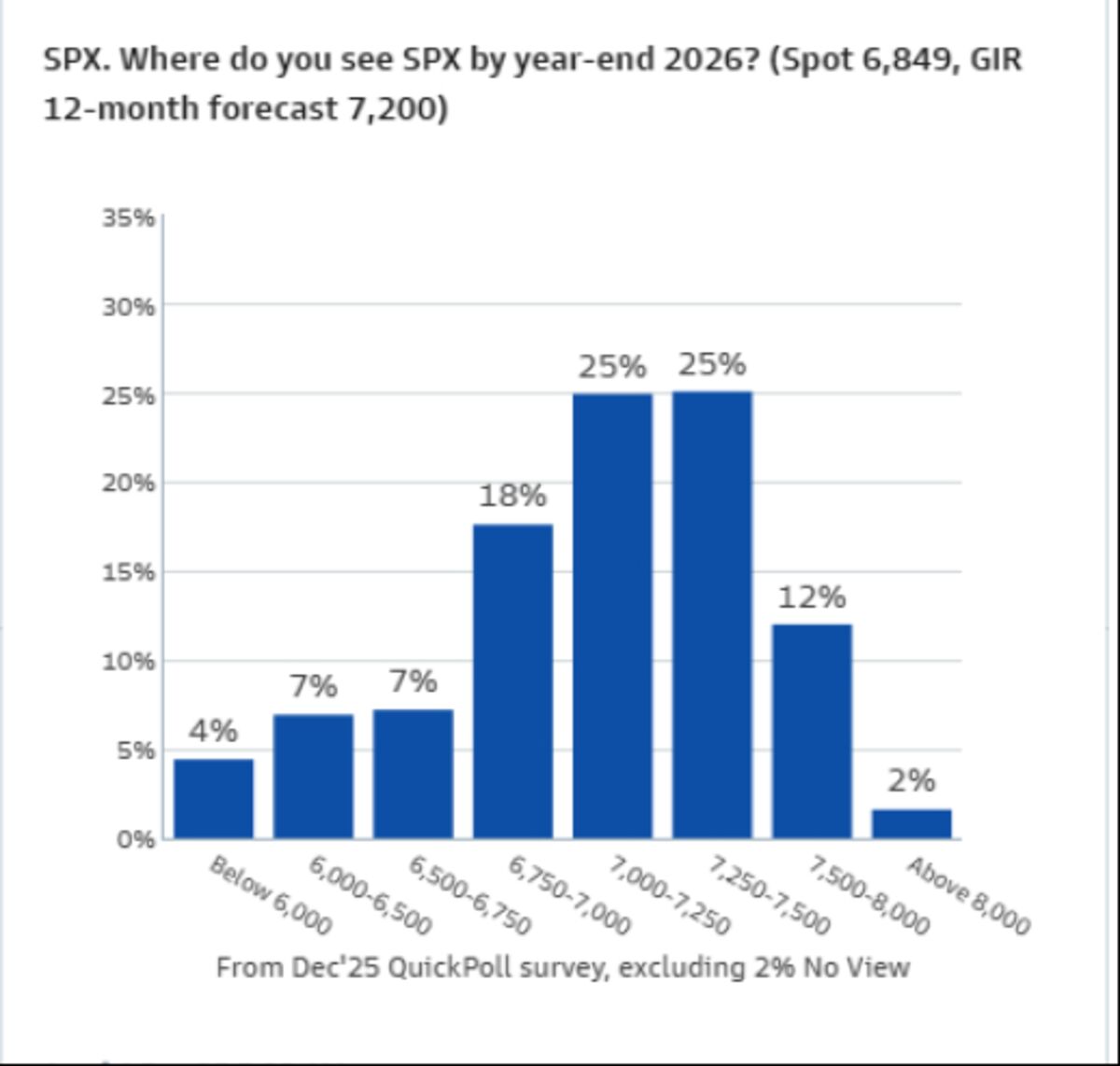

- Goldman Sachs Group Inc. has reported that its clients are adopting a more cautious stance regarding investments in artificial intelligence and U.S. stocks, particularly following a significant decline in the S&P 500 last month. Survey data indicates a shift towards conservative expectations for the index as it approaches 2026.

- This shift in client sentiment is critical for Goldman Sachs as it reflects broader investor concerns about market volatility and the sustainability of growth driven by AI, which could impact the firm's advisory and investment strategies moving forward.

- The current market environment is characterized by heightened anxiety over the Federal Reserve's policies, inflated valuations in AI, and a series of stock market downturns, suggesting that investors are increasingly wary of potential overextensions in the market, particularly in technology sectors.

— via World Pulse Now AI Editorial System