Small Correction 'Not Unhealthy' Says JP Morgan's Grace Peters

NegativeFinancial Markets

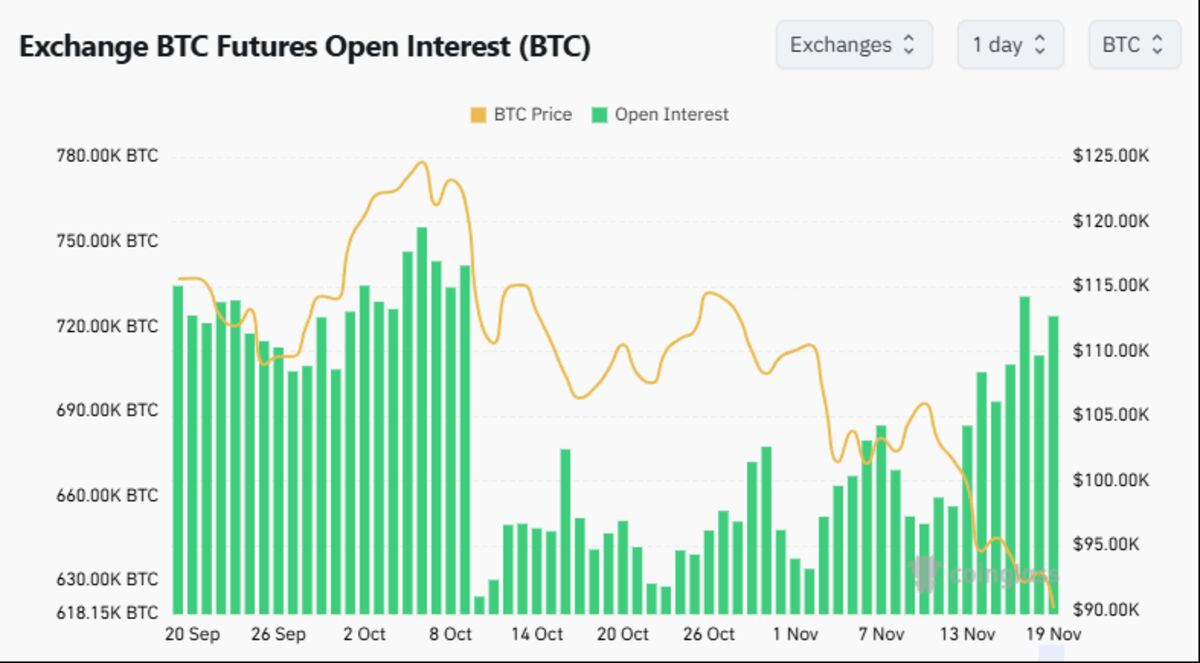

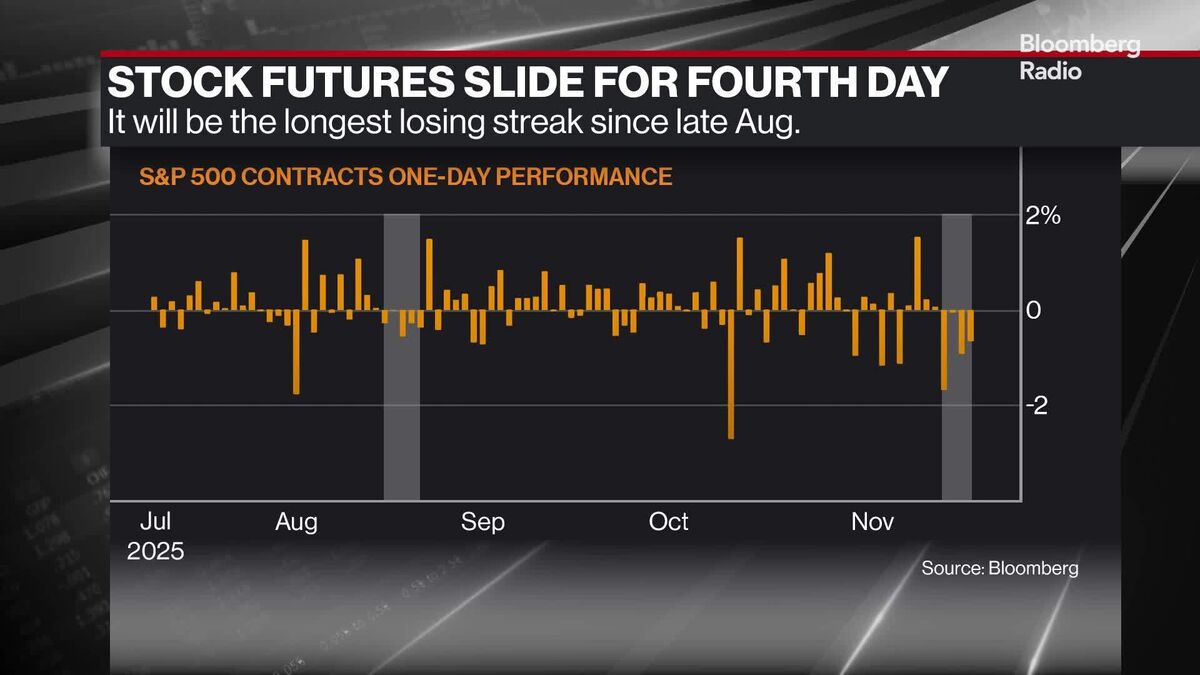

- The S&P 500 is facing a potential fourth straight decline as investor concerns grow over the Federal Reserve's policy direction, high AI valuations, and a significant Bitcoin selloff. This downturn reflects broader anxieties in the market, particularly as the index trades above its historical earnings average.

- Grace Peters, Co

- The current market environment is characterized by heightened volatility, with major indices experiencing significant losses. The S&P 500's struggles are compounded by fears of an AI bubble and the impact of the longest U.S. government shutdown, indicating a complex interplay of factors affecting investor sentiment.

— via World Pulse Now AI Editorial System