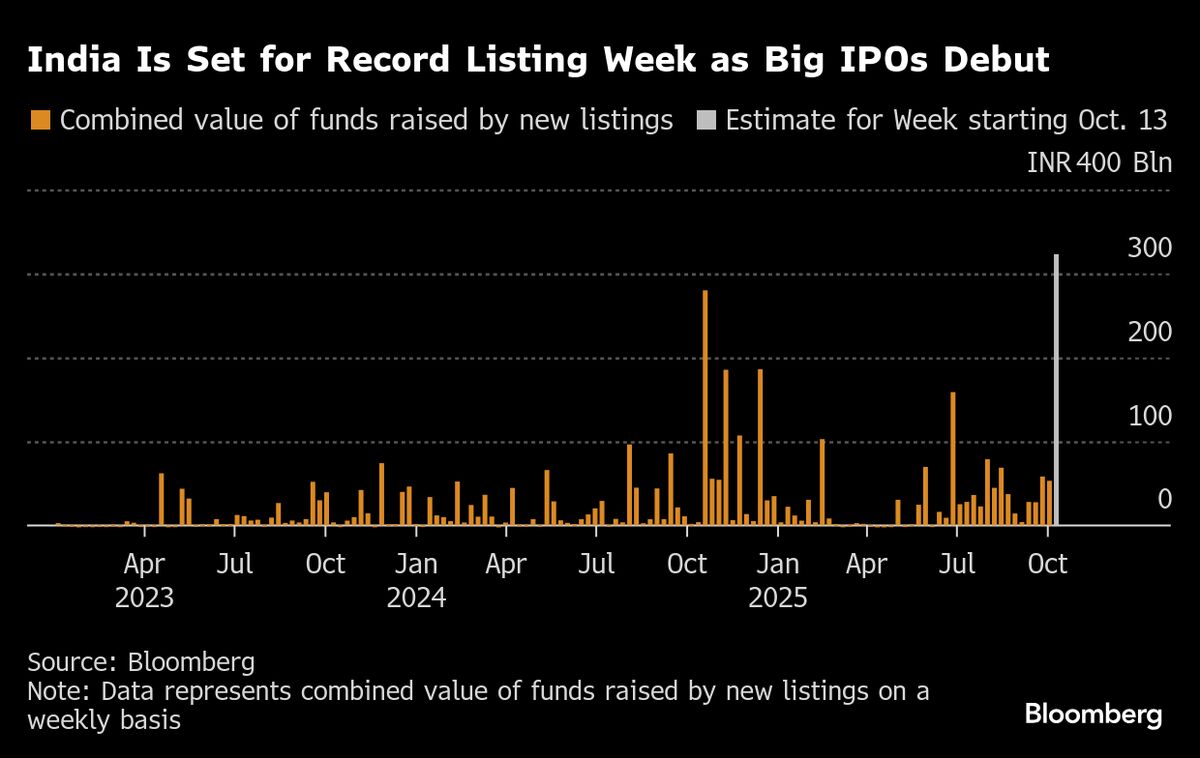

Tata Capital Set for Debut After India’s Biggest IPO of Year

PositiveFinancial Markets

Tata Capital Ltd. is gearing up for its trading debut in Mumbai following a successful initial public offering, marking it as India's largest IPO of the year. This significant milestone not only highlights the company's growth potential but also reflects the robust interest in the Indian market, making it a noteworthy event for investors and the economy.

— Curated by the World Pulse Now AI Editorial System