Cybersecurity Firm Netskope Climbs 18% After $908 Million IPO

PositiveFinancial Markets

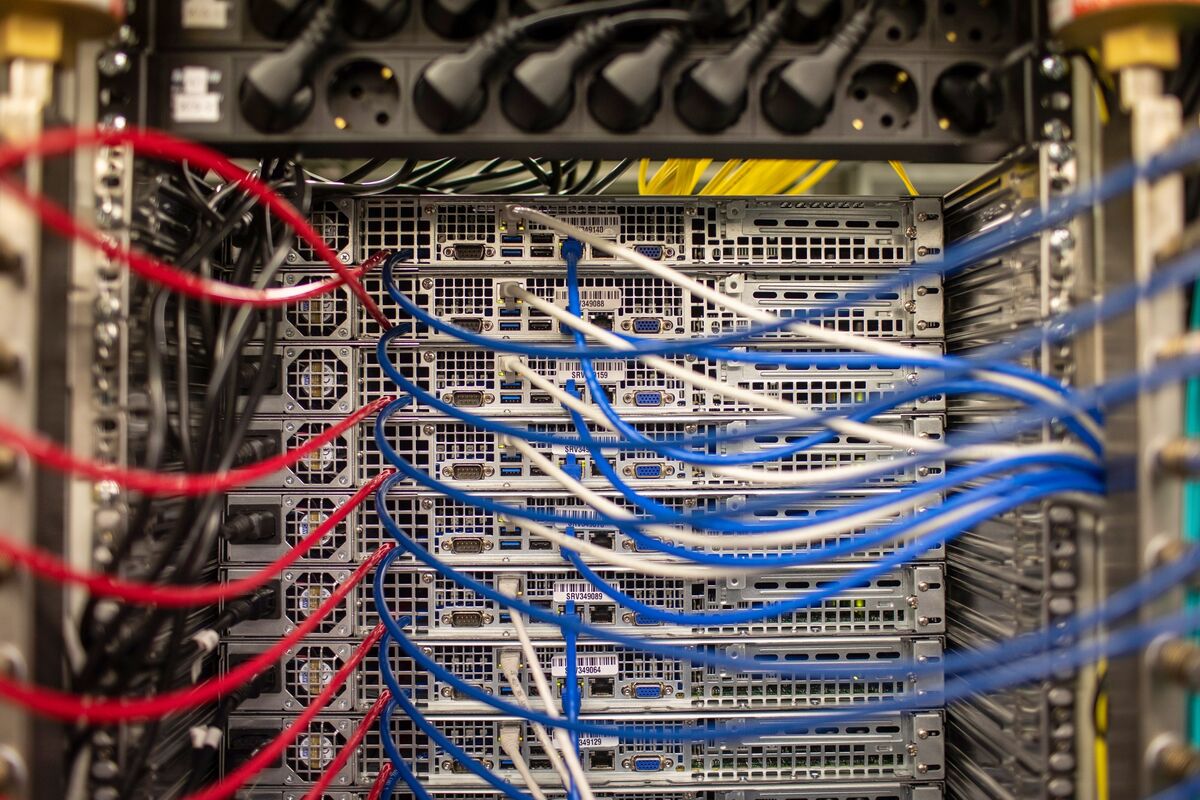

Netskope Inc. has made a significant splash in the market, soaring 18% on its first day of trading following a successful initial public offering that raised $908.2 million. This impressive debut not only highlights the growing demand for cybersecurity solutions but also positions Netskope as a key player in the industry, attracting attention from investors eager to capitalize on the increasing focus on digital security.

— Curated by the World Pulse Now AI Editorial System