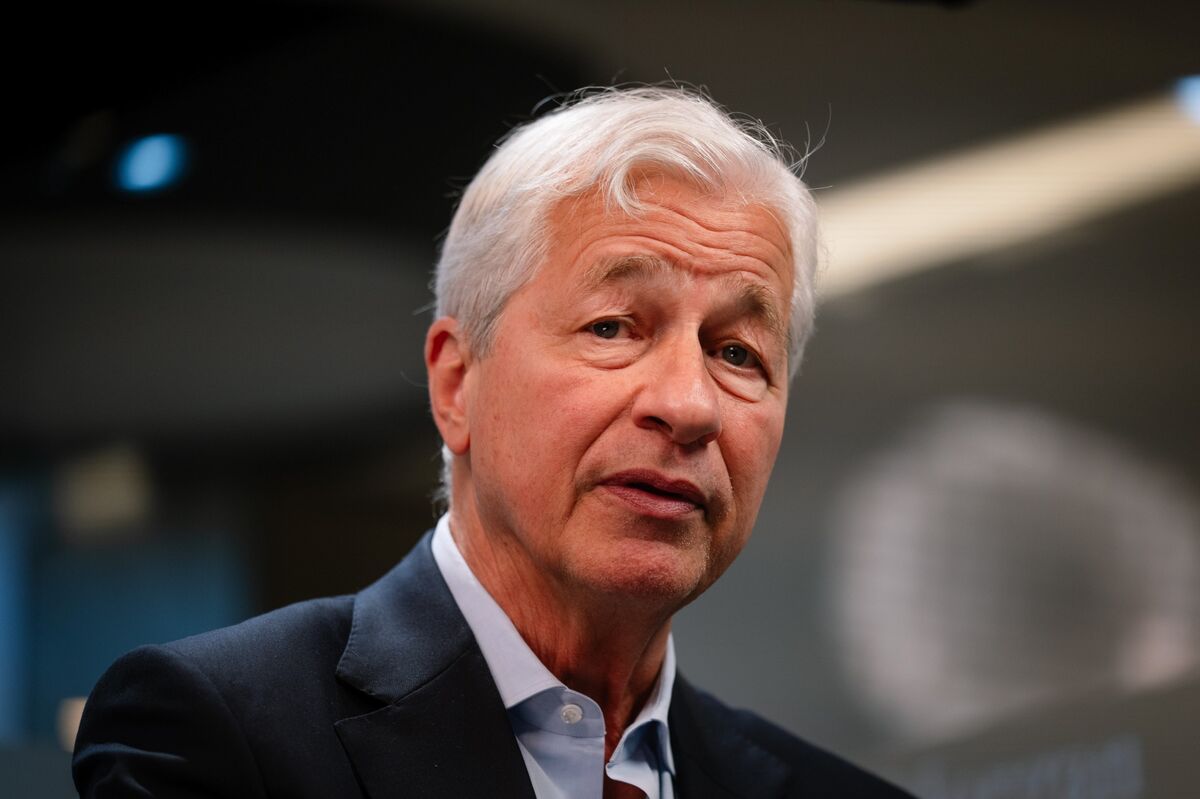

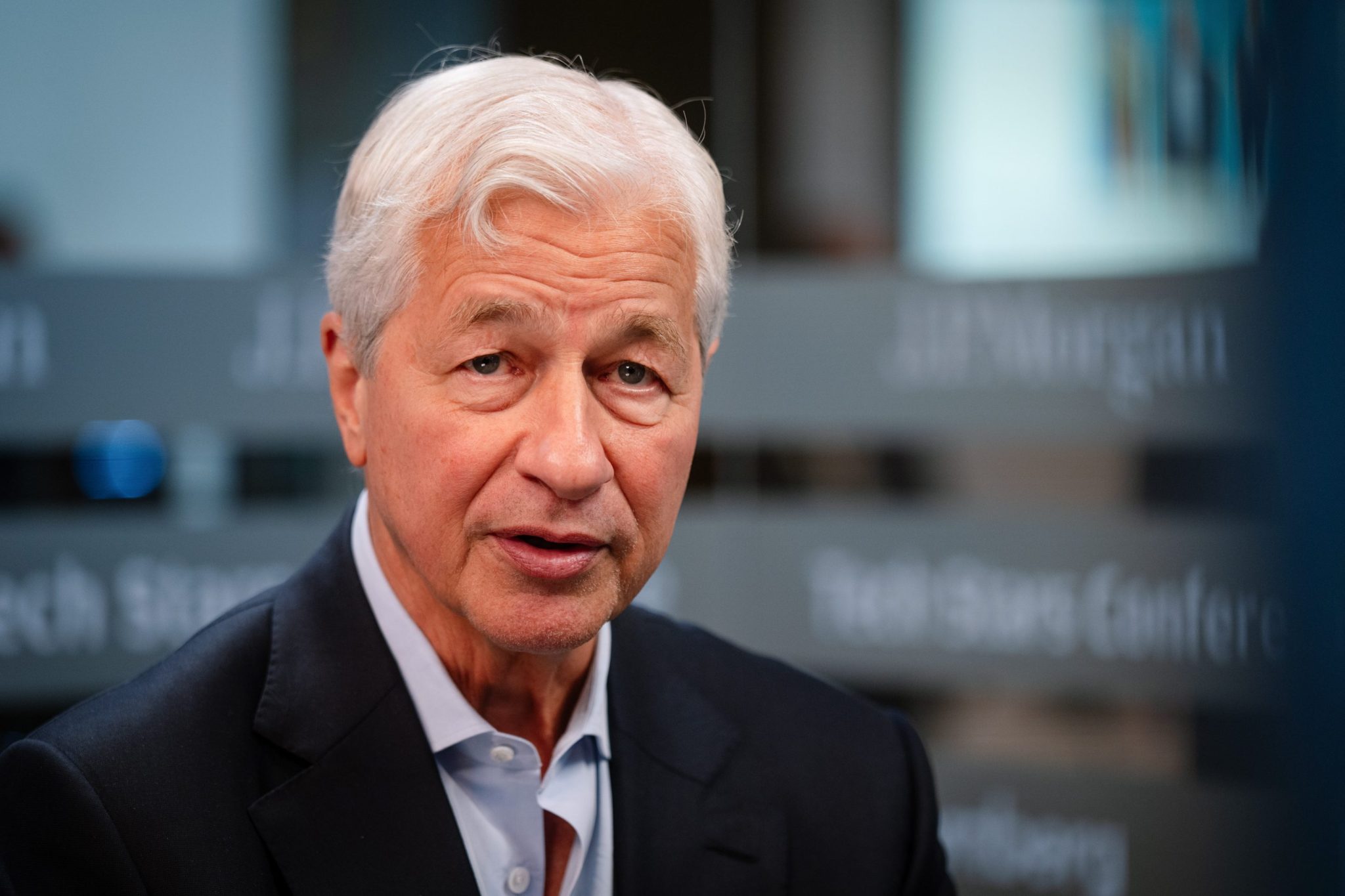

Jamie Dimon Warns on Credit Quality, Trump Meets with Milei | Bloomberg Markets 10/14/2025

NeutralFinancial Markets

In a recent episode of Bloomberg Markets, Jamie Dimon raised concerns about credit quality, highlighting potential risks in the financial landscape. Meanwhile, former President Trump met with Argentine presidential candidate Javier Milei, signaling possible shifts in international relations and economic policies. These discussions are crucial as they reflect the current state of the markets and the implications for investors and policymakers alike.

— Curated by the World Pulse Now AI Editorial System