Three Charts That Offer Hopes to Japan’s Beleaguered Bond Bulls

PositiveFinancial Markets

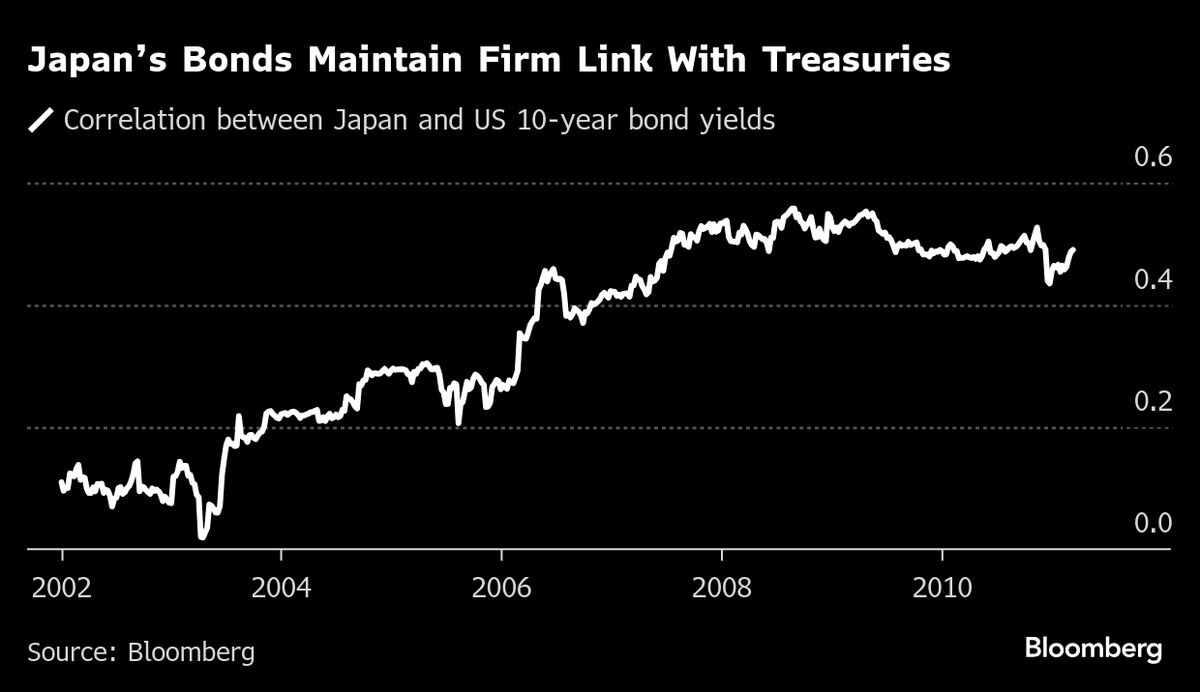

Despite the recent slump in Japan's government bond market, there are signs that could bring hope to bond bulls. Analysts point to several charts indicating potential stabilization, which could encourage investors to remain optimistic about future market conditions. This matters because a stabilized bond market can lead to increased confidence in Japan's economy and attract more investment.

— Curated by the World Pulse Now AI Editorial System