BofA downgrades Apple Hospitality and Summit Hotel amid demand uncertainty

NegativeFinancial Markets

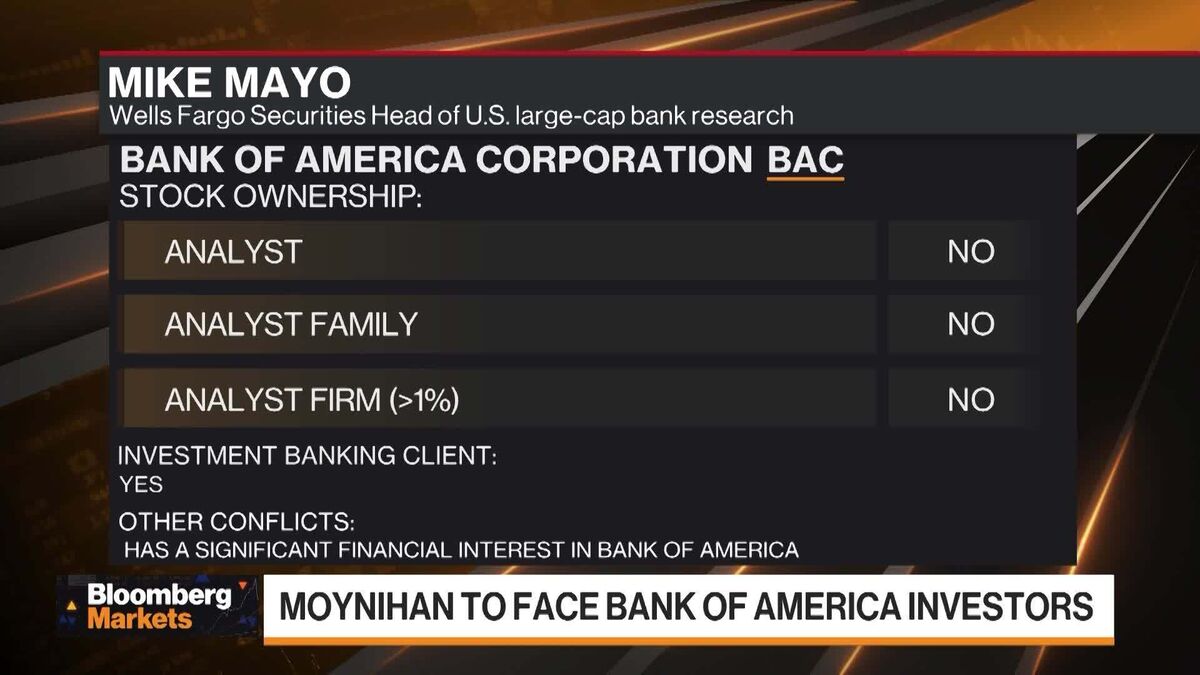

Bank of America has downgraded its ratings for Apple Hospitality and Summit Hotel due to concerns over demand uncertainty in the hospitality sector. This decision reflects broader worries about the economic environment and its impact on travel and accommodation. Investors should pay attention to these developments as they could signal challenges ahead for the hotel industry.

— Curated by the World Pulse Now AI Editorial System