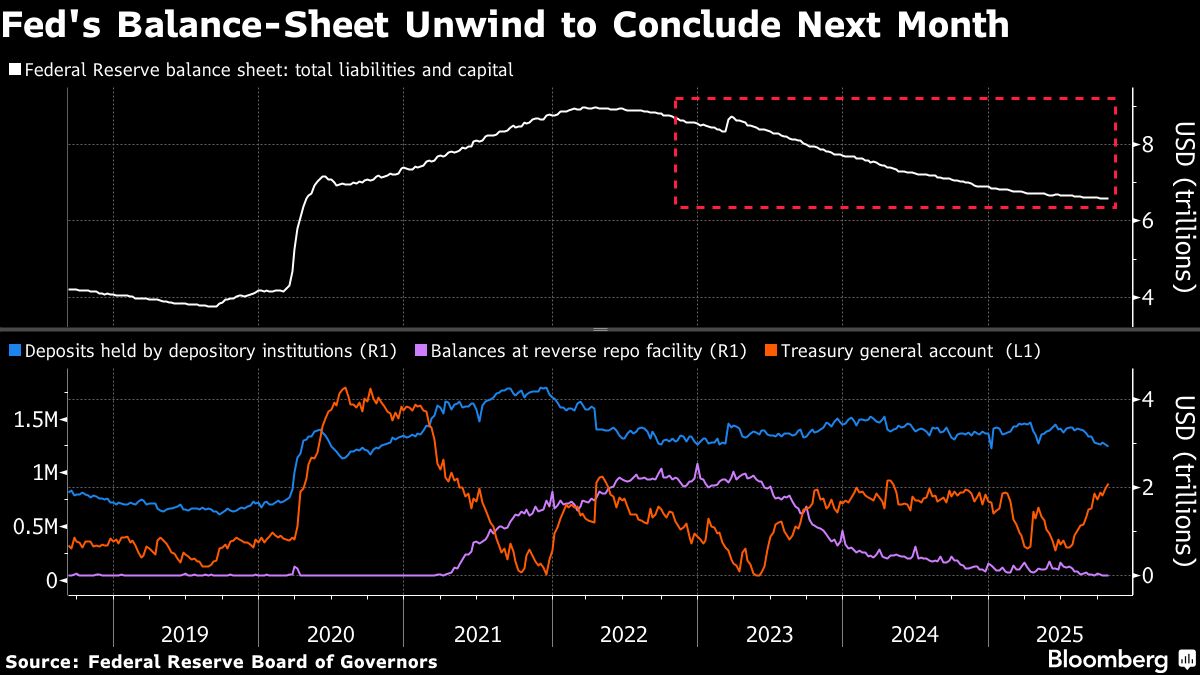

Banxico policy rate expected to drop 25bp to 7.25% in November, BofA says

PositiveFinancial Markets

Bank of America predicts that Mexico's central bank, Banxico, will lower its policy rate by 25 basis points to 7.25% in November. This potential rate cut is significant as it reflects the bank's response to economic conditions and aims to stimulate growth. A lower interest rate can encourage borrowing and spending, which is crucial for economic recovery, especially in the current climate.

— Curated by the World Pulse Now AI Editorial System