Euro, yen slide for third straight day versus US dollar on political jitters

NegativeFinancial Markets

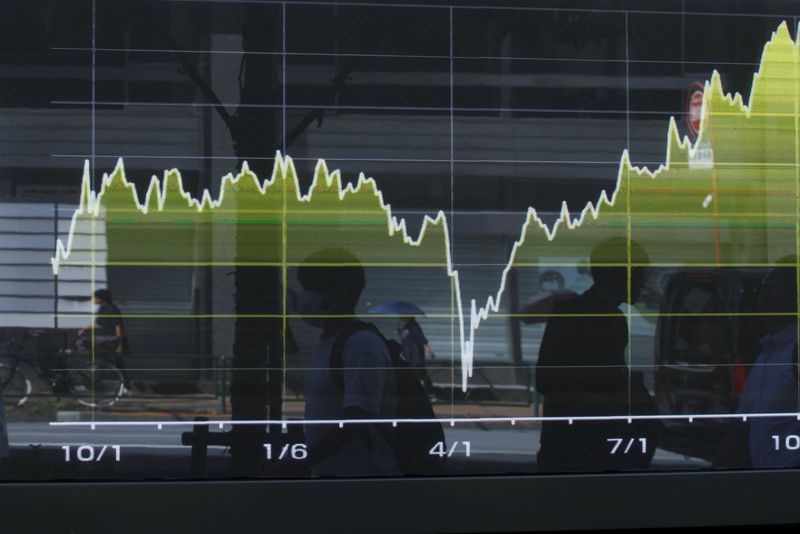

The euro and yen have both declined for the third consecutive day against the US dollar, driven by rising political uncertainties. This trend highlights the ongoing volatility in the currency markets, which can impact international trade and investment decisions. Investors are closely monitoring these developments, as fluctuations in currency values can affect economic stability and growth prospects.

— Curated by the World Pulse Now AI Editorial System