Oracle, Andreessen Horowitz, More Will Hold Controlling Stake In TikTok Deal, Report Says

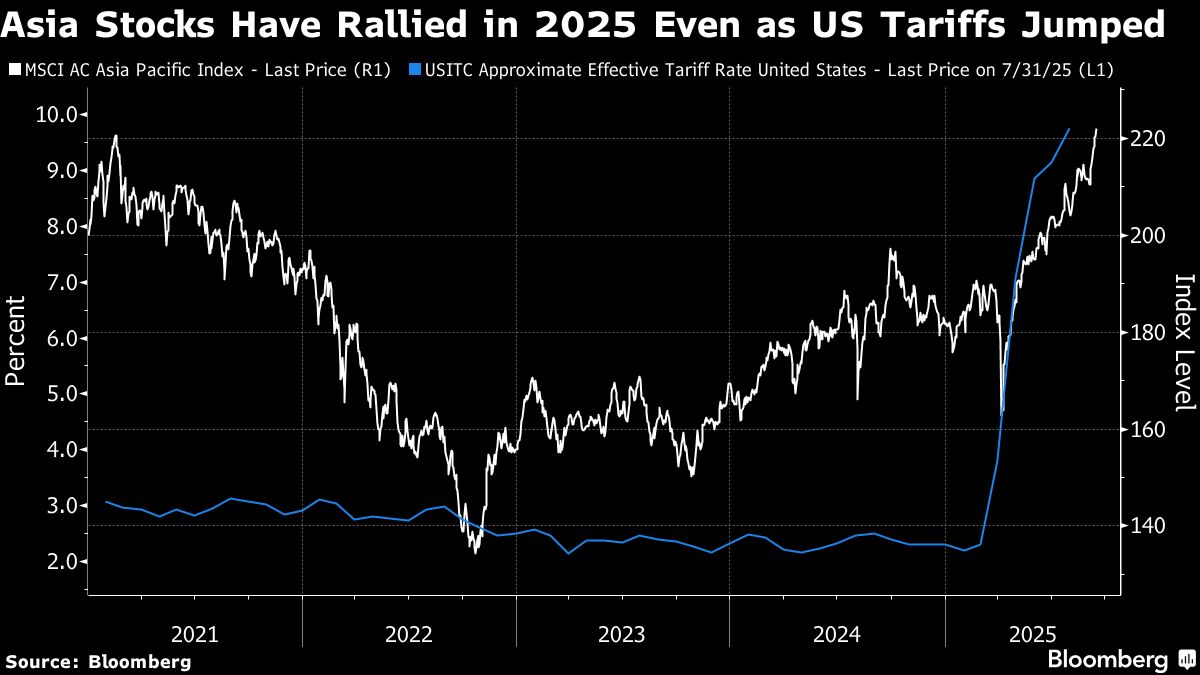

PositiveFinancial Markets

A recent report indicates that Oracle and Andreessen Horowitz will hold a controlling stake in the TikTok deal, a move that President Donald Trump has hinted at as a significant step forward. This development is crucial as it not only impacts the future of TikTok in the U.S. but also reflects the ongoing negotiations surrounding data privacy and national security. The involvement of major players like Oracle suggests a strategic approach to addressing these concerns while keeping the popular app operational.

— Curated by the World Pulse Now AI Editorial System