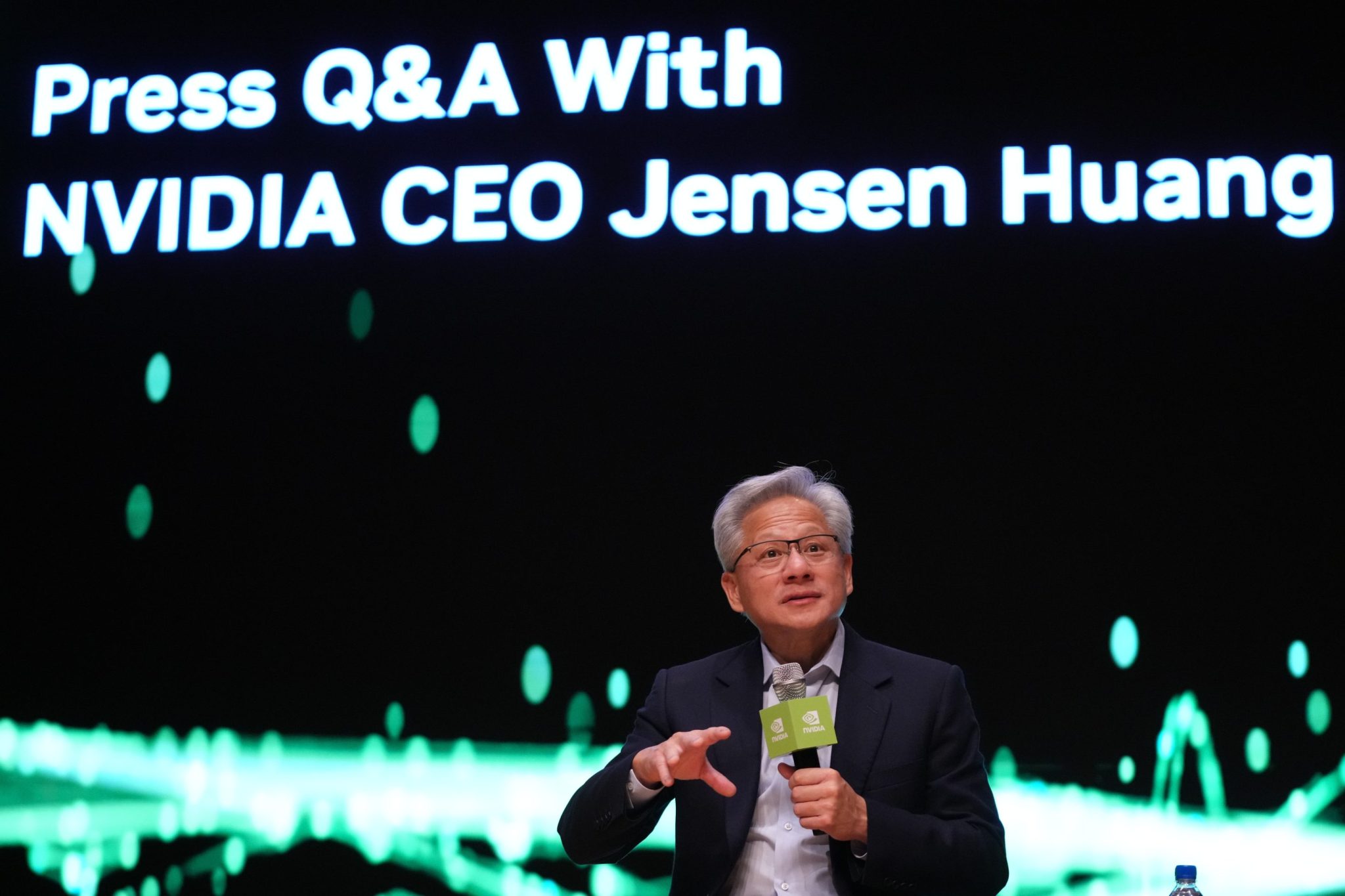

Veteran analyst delivers surprise post-Q3 verdict on Nvidia

PositiveFinancial Markets

- Nvidia reported impressive Q3 earnings of $57 billion, surpassing expectations and showcasing robust data-center sales of $51.2 billion, which highlights its leadership in the AI market.

- This strong performance is crucial for Nvidia as it reinforces investor confidence and positions the company favorably amidst concerns about the sustainability of the AI boom.

- The results have generated excitement among investors, alleviating fears of an AI bubble and reflecting a broader trend of increasing demand for AI technologies and infrastructure.

— via World Pulse Now AI Editorial System