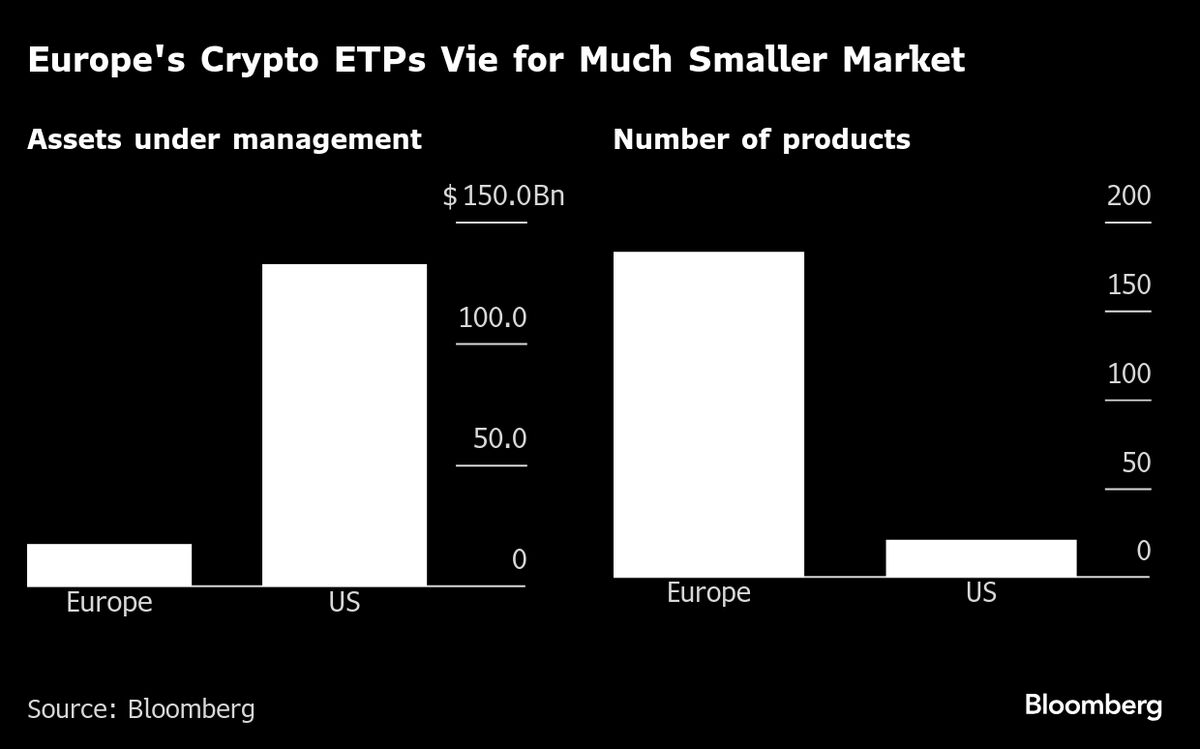

Beijing moves to liquidate seized crypto in Hong Kong as Grayscale partners with BNY Mellon for its digital fund, while the UK considers allowing retail crypto ETFs, signaling shifting global crypto regulations and institutional adoption.

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

8,546

152

211

12 minutes ago

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more

Why World Pulse Now?

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Topics

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Live Stats

8,546

152

211

12 minutes ago

Mobile App

Get instant summaries, explore trending stories, and dive deeper into the headlines — all in one sleek, noise-free mobile experience.

1-Minute Daily Briefing

Stay sharp in 60 seconds. Get concise summaries of today’s biggest stories — markets, tech, sports, and more