Wall Street Week | Hubbard on Fed Cut Fallout, Open Source AI, Nuclear Bet, Department Store Revival

NeutralTechnology

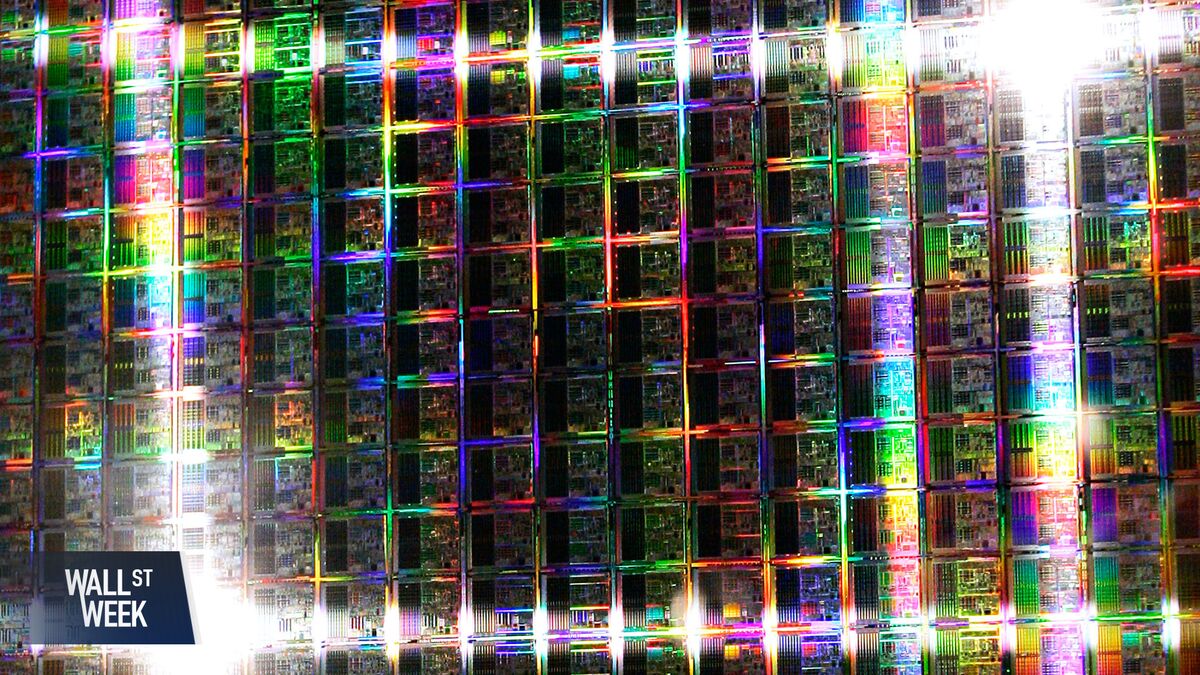

- Glenn Hubbard has raised concerns regarding the Federal Reserve's potential interest rate cuts, highlighting risks from tariffs, uncertain economic data, and a mature credit cycle as the Fed looks ahead to 2026. Additionally, discussions around the competition between open-source AI ecosystems and closed models are gaining traction, with insights from industry leaders like Lisa Su and Sam Palmisano.

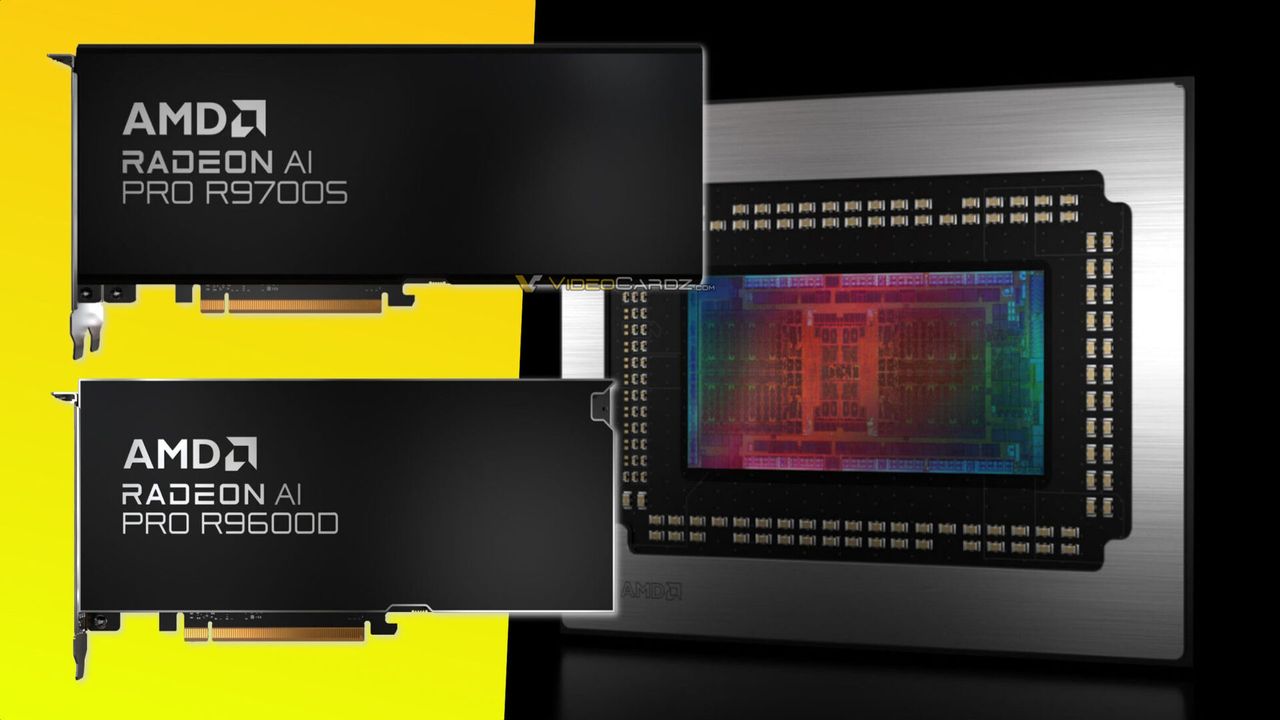

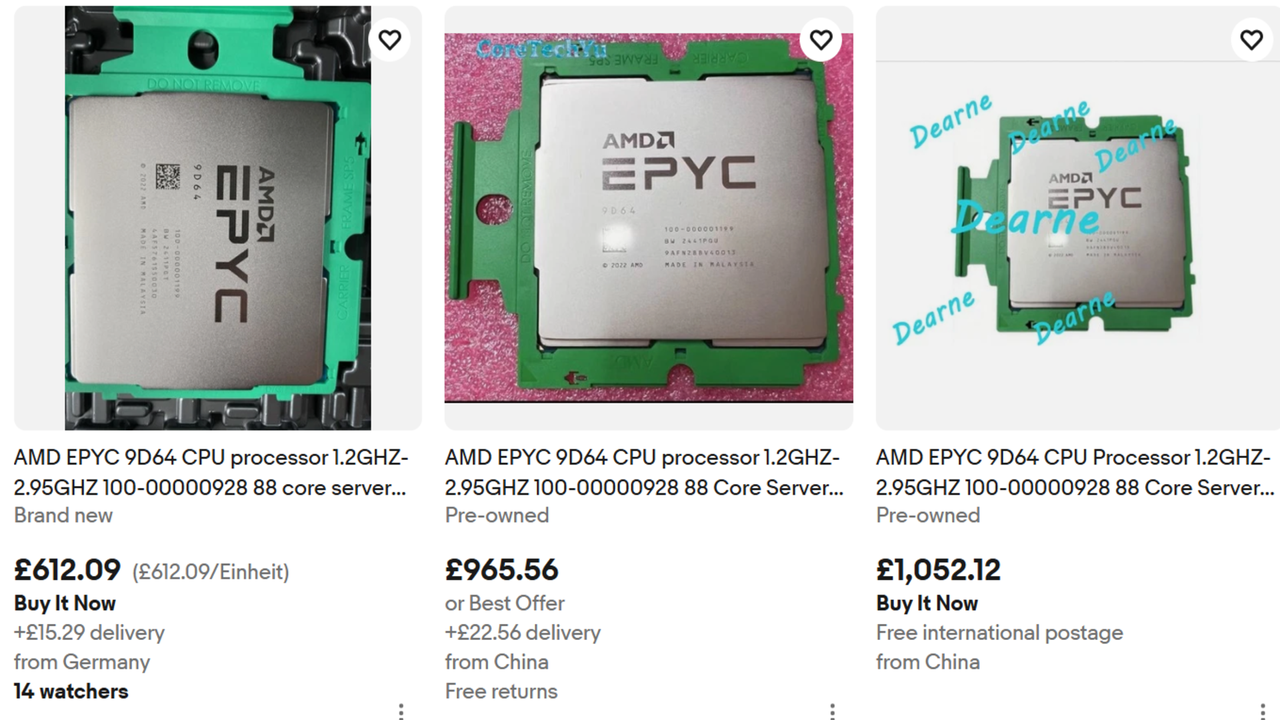

- The implications of Hubbard's warnings are significant for investors and policymakers, as they suggest a need for caution in navigating the economic landscape. The evolving dynamics in the AI sector, particularly with AMD's strategic moves under Lisa Su, could reshape competitive advantages in technology.

- The ongoing debate about the AI market's sustainability and the potential for an AI bubble reflects broader concerns in the tech industry. As companies like AMD position themselves against giants like Nvidia, the focus on innovation and market share becomes critical, influencing not only corporate strategies but also the future of technology and manufacturing sectors.

— via World Pulse Now AI Editorial System