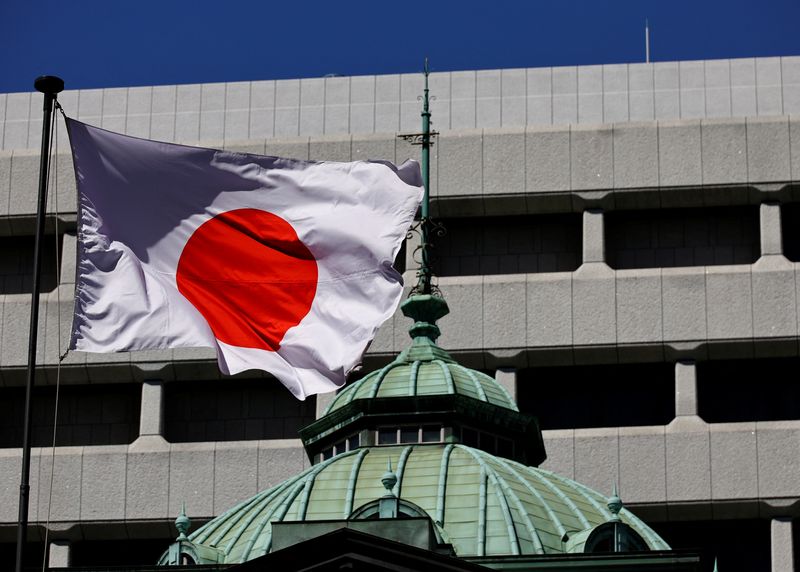

Bank of Japan Maintains Interest Rates and Begins ETF Sales

The Bank of Japan (BOJ) has decided to keep interest rates steady while starting to sell exchange-traded funds (ETFs). This decision reflects the BOJ's strategy to maintain economic stability and influence market conditions. By holding rates steady, the BOJ aims to support growth, while the ETF sales indicate a potential shift in asset management that could affect investors and the economy.

Bank of Japan Maintains Interest Rates and Begins ETF Sales

The Bank of Japan (BOJ) has decided to keep interest rates steady while starting to sell exchange-traded funds (ETFs). This decision reflects the BOJ's strategy to maintain economic stability and influence market conditions. By holding rates steady, the BOJ aims to support growth, while the ETF sales indicate a potential shift in asset management that could affect investors and the economy.

Why World Pulse Now

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

Our system has analyzed 4,996 articles worldwide

~208 per hour

617 trending stories shaping headlines

From breaking news to viral moments

Monitoring 200 trusted sources

Major outlets & specialized publications

Latest update 6 minutes ago

Always fresh