S&P Downgrades France's Credit Rating Amid Political Instability

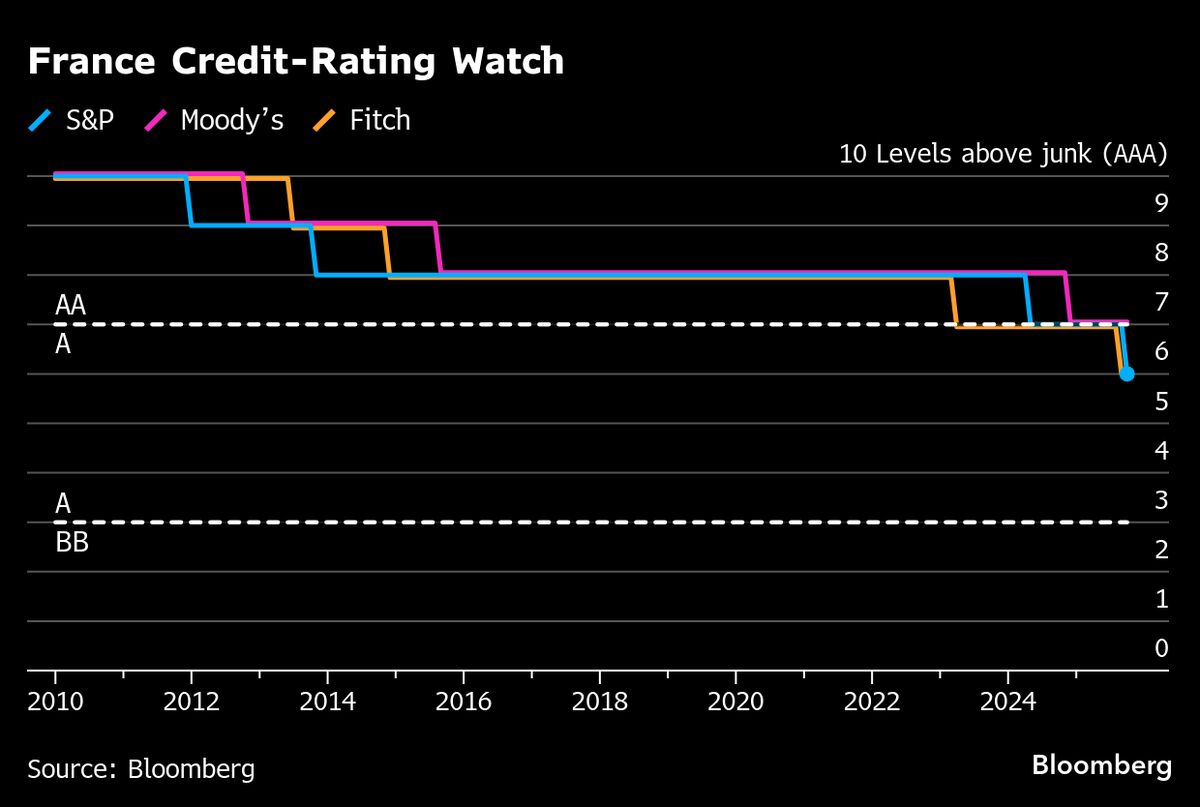

S&P Global has downgraded France's credit rating from AA to A+, citing concerns over political instability and rising debt levels. This unexpected decision raises alarms about the government's financial management and could impact investor confidence, complicating efforts to stabilize the economy. The downgrade marks a significant challenge for Finance Minister Sébastien Lecornu as France navigates a difficult economic landscape.

S&P Downgrades France's Credit Rating Amid Political Instability

S&P Global has downgraded France's credit rating from AA to A+, citing concerns over political instability and rising debt levels. This unexpected decision raises alarms about the government's financial management and could impact investor confidence, complicating efforts to stabilize the economy. The downgrade marks a significant challenge for Finance Minister Sébastien Lecornu as France navigates a difficult economic landscape.

Why World Pulse Now

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

Our system has analyzed 4,791 articles worldwide

~199 per hour

509 trending stories shaping headlines

From breaking news to viral moments

Monitoring 198 trusted sources

Major outlets & specialized publications

Latest update 12 minutes ago

Always fresh