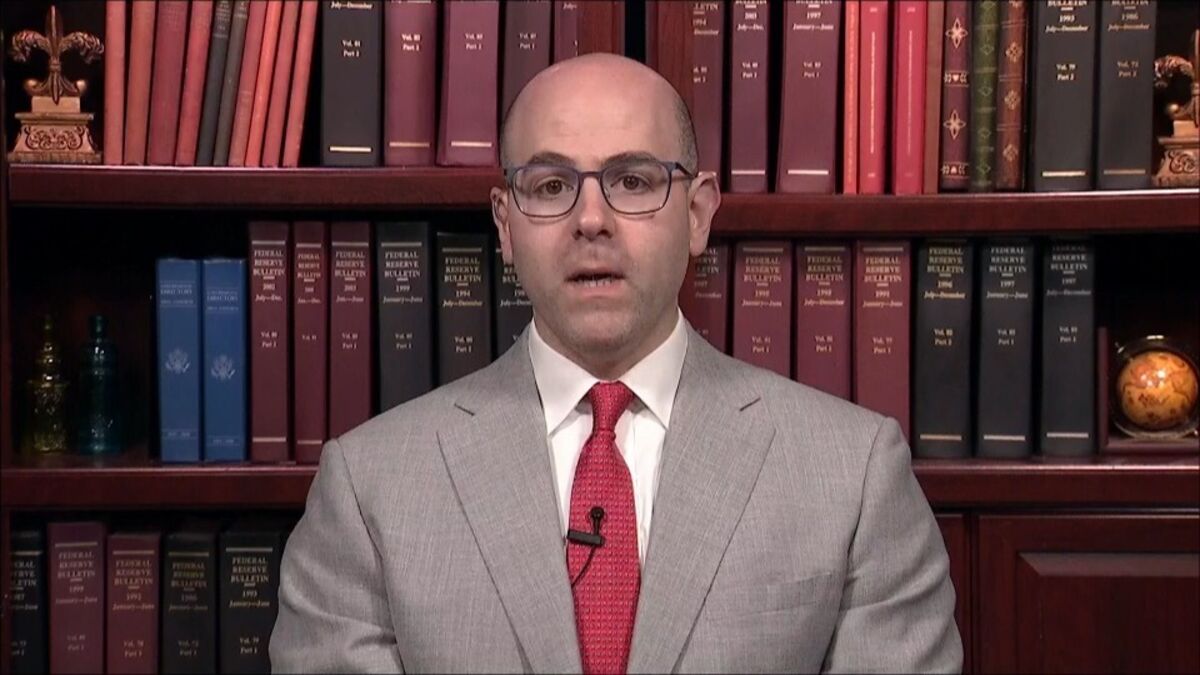

Fed's Miran Advocates for Rapid Interest Rate Cuts Amid Economic Concerns

Federal Reserve Governor Stephen Miran is pushing for swift interest rate cuts to address economic vulnerabilities, arguing that current rates are too high and could harm growth. His stance has sparked debate among Fed policymakers, with some advocating for a more cautious approach. Miran's comments reflect a significant shift in monetary policy thinking, emphasizing the urgency of timely action to prevent potential economic downturns.

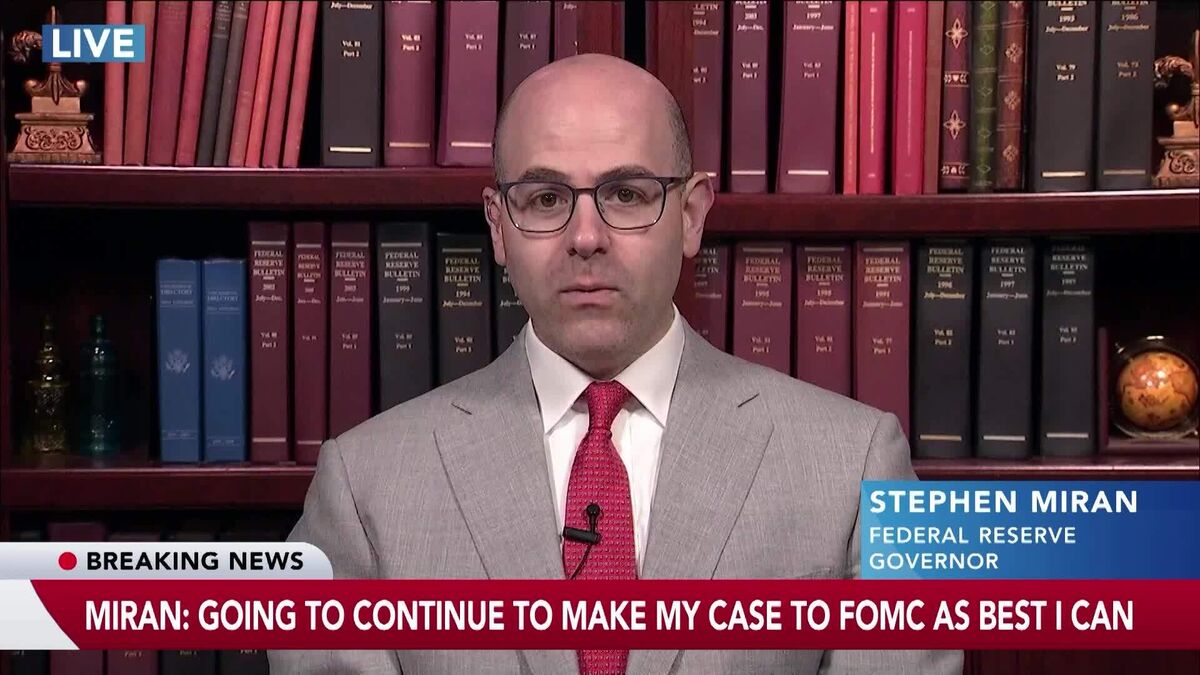

Fed's Miran Advocates for Rapid Interest Rate Cuts Amid Economic Concerns

Federal Reserve Governor Stephen Miran is pushing for swift interest rate cuts to address economic vulnerabilities, arguing that current rates are too high and could harm growth. His stance has sparked debate among Fed policymakers, with some advocating for a more cautious approach. Miran's comments reflect a significant shift in monetary policy thinking, emphasizing the urgency of timely action to prevent potential economic downturns.

Why World Pulse Now

Global Coverage

All major sources, one page

Emotional Lens

Feel the mood behind headlines

Trending Stories

Know what’s trending, globally

Read Less, Know More

Get summaries. Save time

Multi-Language

Switch languages to read your way

Save for Later

Your stories, stored for later

Live Stats

Our system has analyzed 4,588 articles worldwide

~191 per hour

609 trending stories shaping headlines

From breaking news to viral moments

Monitoring 198 trusted sources

Major outlets & specialized publications

Latest update 20 minutes ago

Always fresh