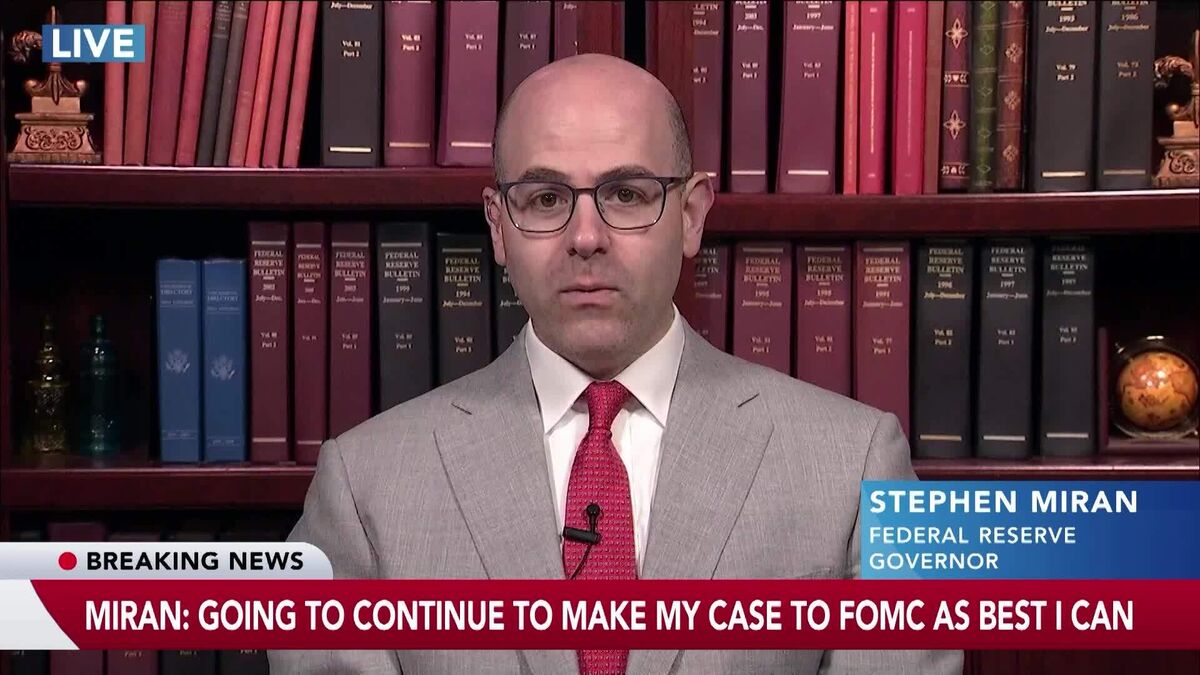

Fed’s Miran on Neutral Rate, Tight Monetary Policy, Rapid Rate Cuts

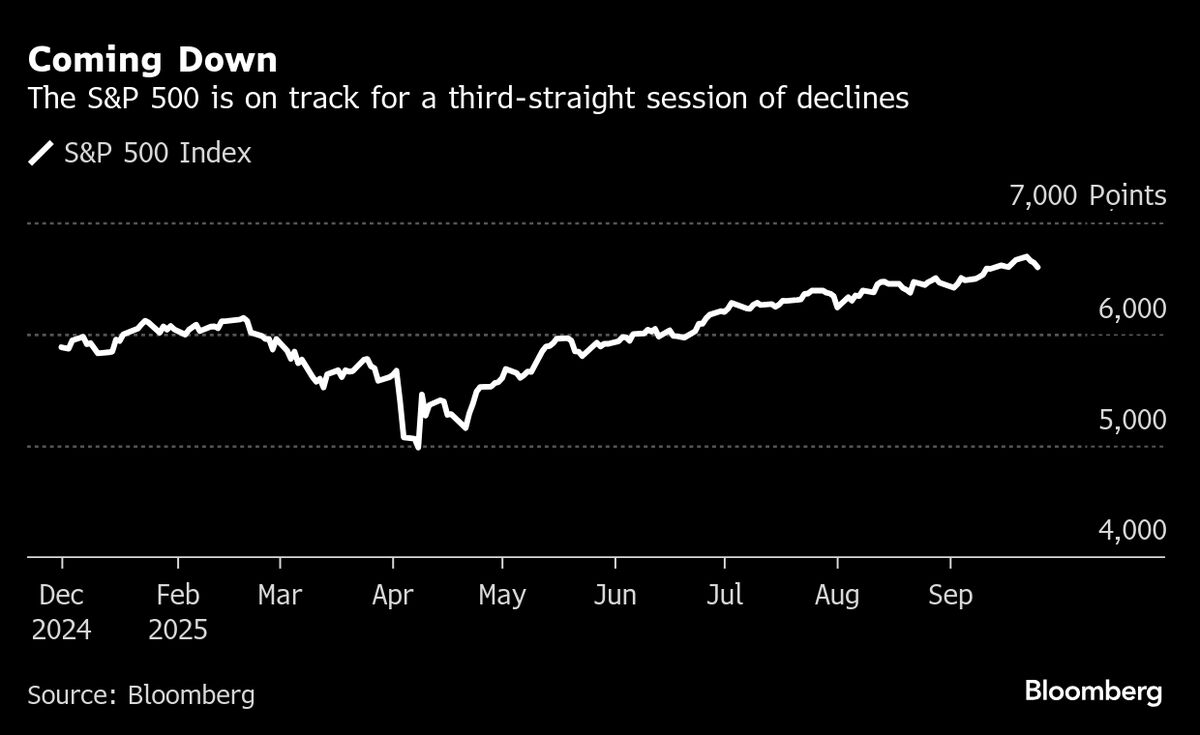

PositiveFinancial Markets

Federal Reserve Governor Stephen Miran recently shared insights from his first Federal Open Market Committee meeting, emphasizing the need for rapid interest rate cuts. He believes that acting proactively to lower rates is crucial to prevent potential economic disasters. His comments on Bloomberg Surveillance highlight a shift in monetary policy thinking, which could have significant implications for the economy and financial markets.

— Curated by the World Pulse Now AI Editorial System