Chinese AI Euphoria Obscures a Gloomier Technological Reality

NeutralArtificial Intelligence

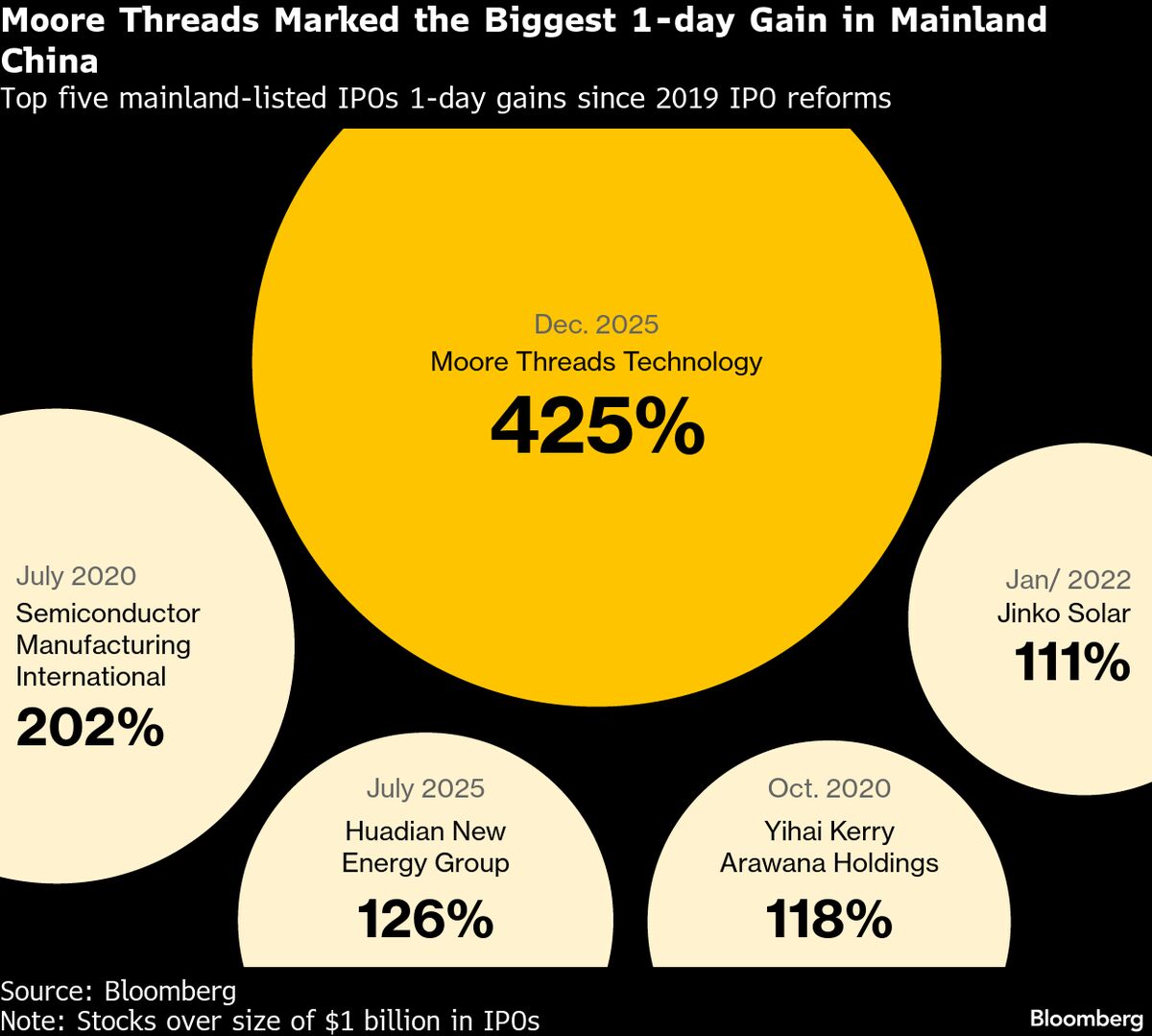

- Moore Threads Technology Co. recently celebrated a significant debut on the Shanghai stock exchange, marking the second-largest initial public offering in China this year. This event has generated considerable excitement among investors regarding China's advancements in artificial intelligence (AI) chips, despite underlying concerns about the sustainability of this enthusiasm.

- The successful IPO of Moore Threads highlights the growing interest in AI technology within China, positioning the company as a key player in a competitive market. However, the rapid rise in its stock price has raised caution among investors about potential trading risks and market volatility.

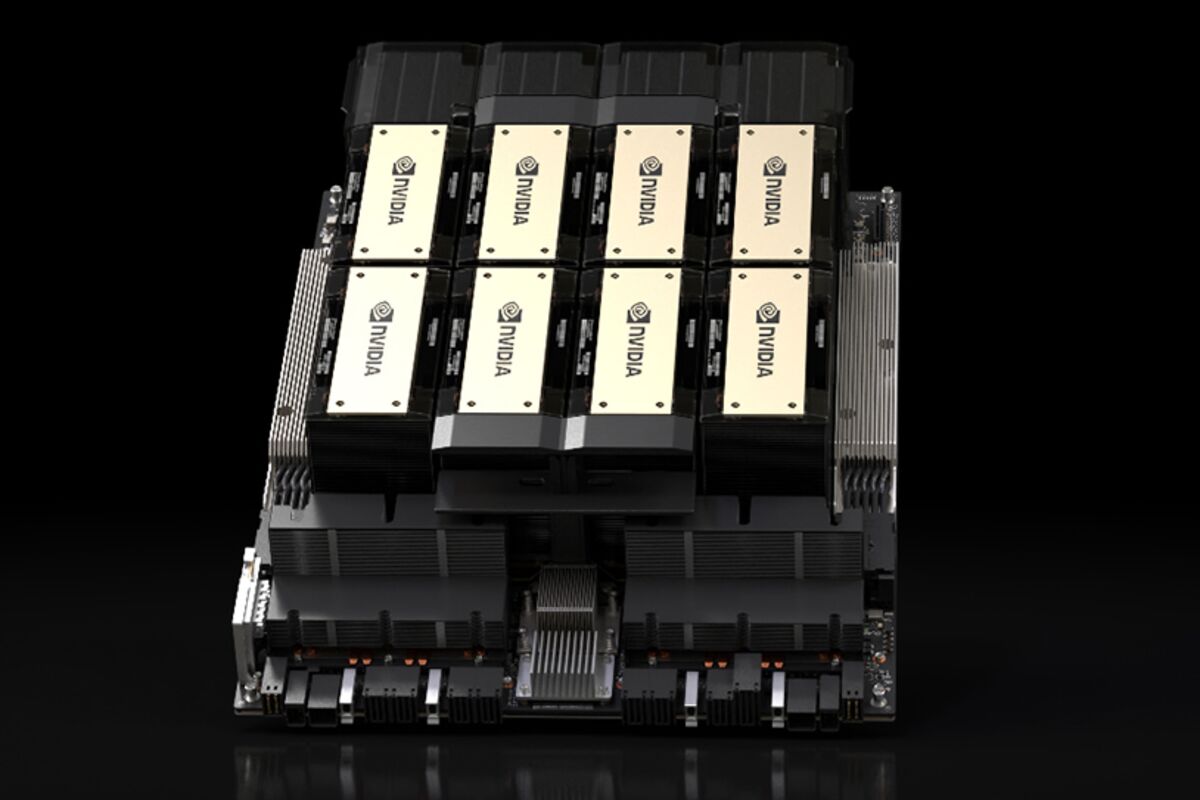

- The broader context reveals a complex landscape for China's AI sector, where significant investments are being made, yet profitability remains uncertain. Companies like ByteDance and DeepSeek are pursuing different strategies in AI, while the recent approval of Nvidia's chip sales to China underscores the ongoing U.S.-China technology rivalry, further complicating the narrative of growth and competition in this field.

— via World Pulse Now AI Editorial System