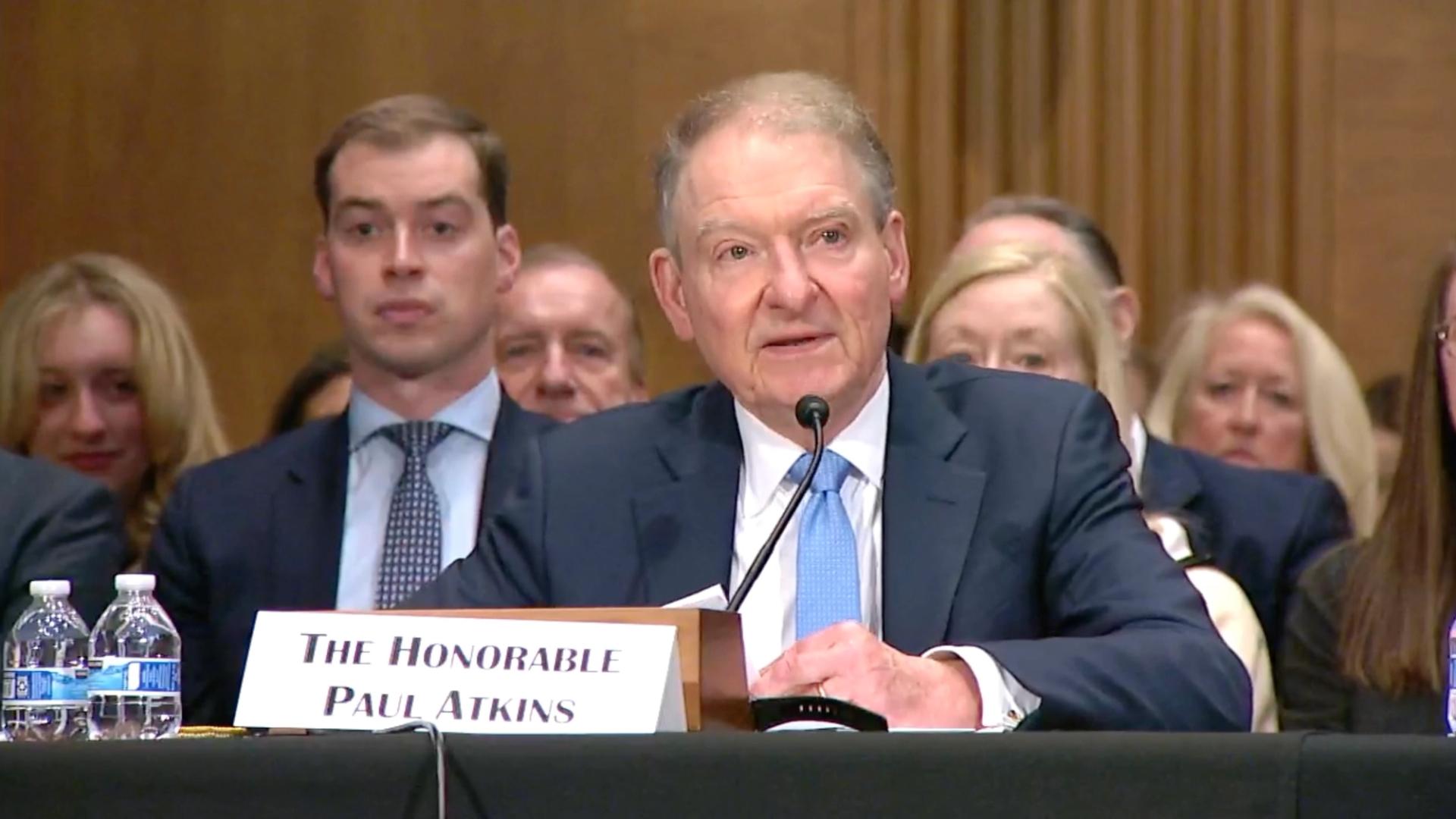

Will Your 401(k) Go Crypto? Washington Pushes SEC To Say Yes

PositiveCryptocurrency

Legislators in Washington are advocating for the Securities and Exchange Commission (SEC) to allow cryptocurrency investments in 401(k) retirement plans, potentially opening up a $12.5 trillion market. This push aligns with President Trump's recent executive order and reflects a growing interest in alternative assets among investors. If successful, this initiative could provide individuals with more diverse investment options for their retirement savings, enhancing financial growth opportunities.

— Curated by the World Pulse Now AI Editorial System