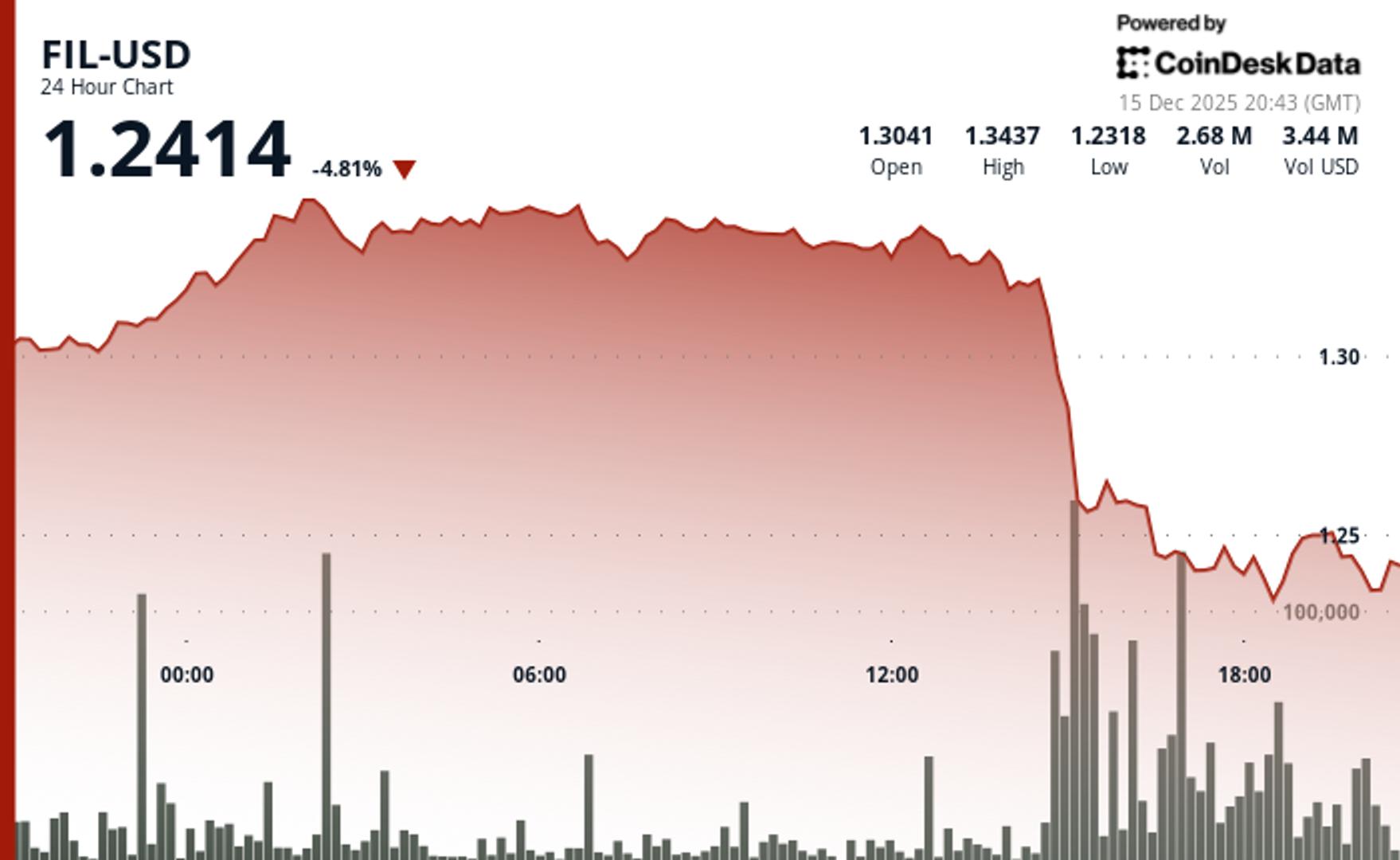

Filecoin slides 5% alongside major decline in broader crypto market

NegativeCryptocurrency

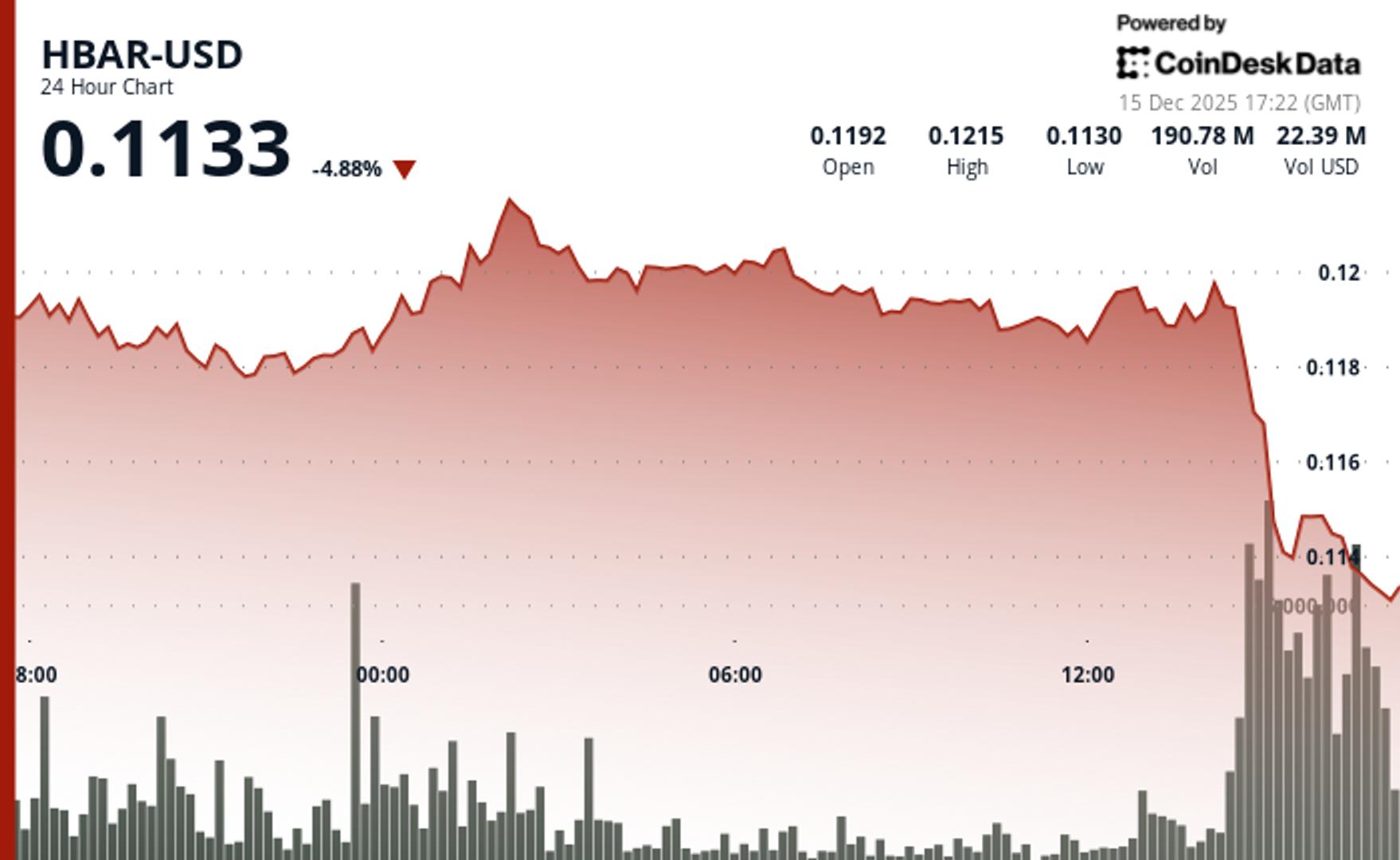

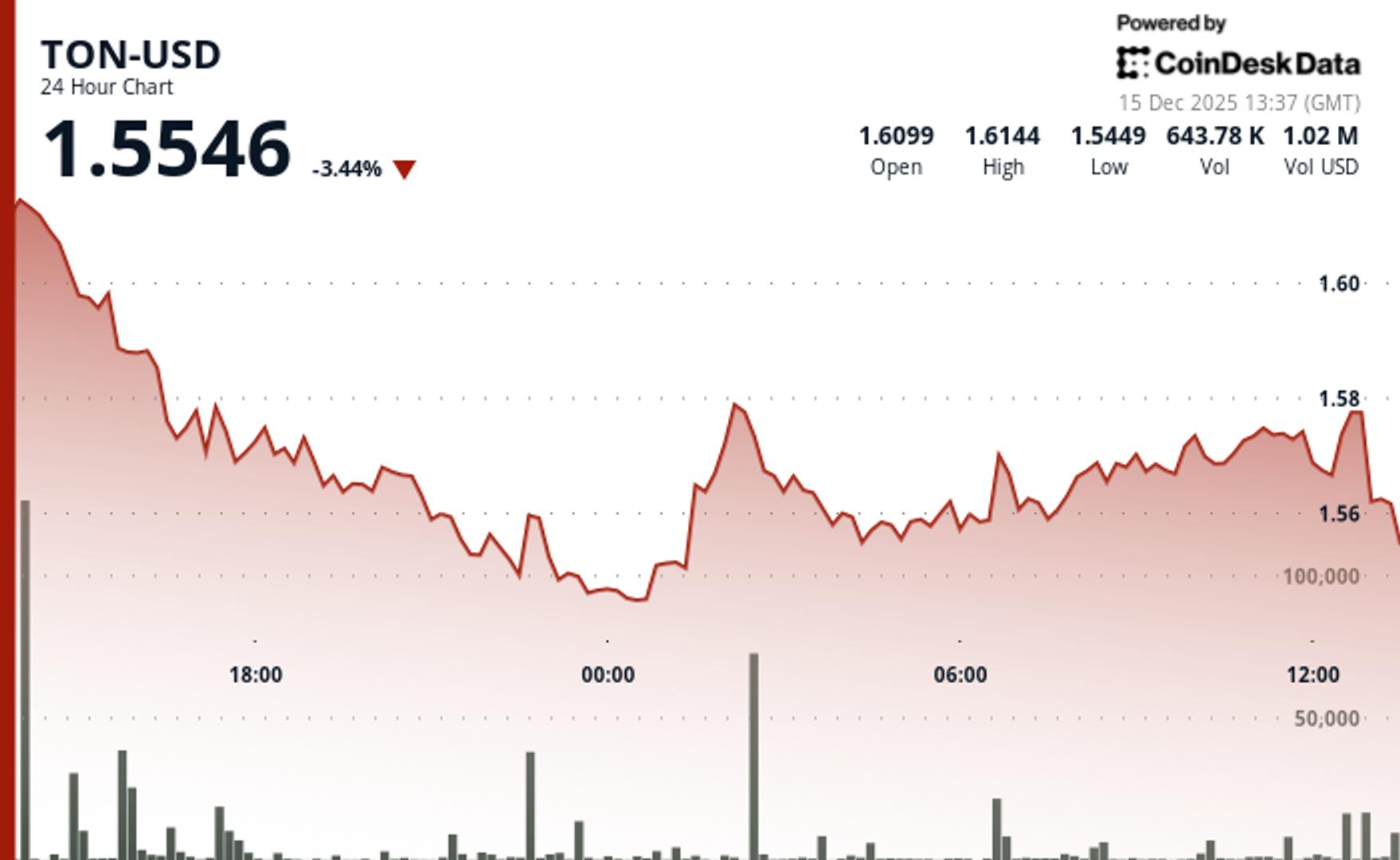

- Filecoin (FIL) has seen a significant decline of 5%, dropping to $1.24 as the cryptocurrency market experiences a broader downturn, characterized by heavy trading volume that is 380% above average. This technical breakdown raises concerns about the stability of the asset.

- The decline in Filecoin's value is critical as it reflects investor sentiment and market dynamics, particularly as it falls below key support levels. Such movements can influence trading strategies and investor confidence in the cryptocurrency sector.

- This downturn is part of a larger trend affecting various cryptocurrencies, including Bitcoin, which has also seen declines. The overall market is grappling with increased sell pressure and volatility, leading to a risk-off mood among investors and impacting altcoin prices significantly.

— via World Pulse Now AI Editorial System