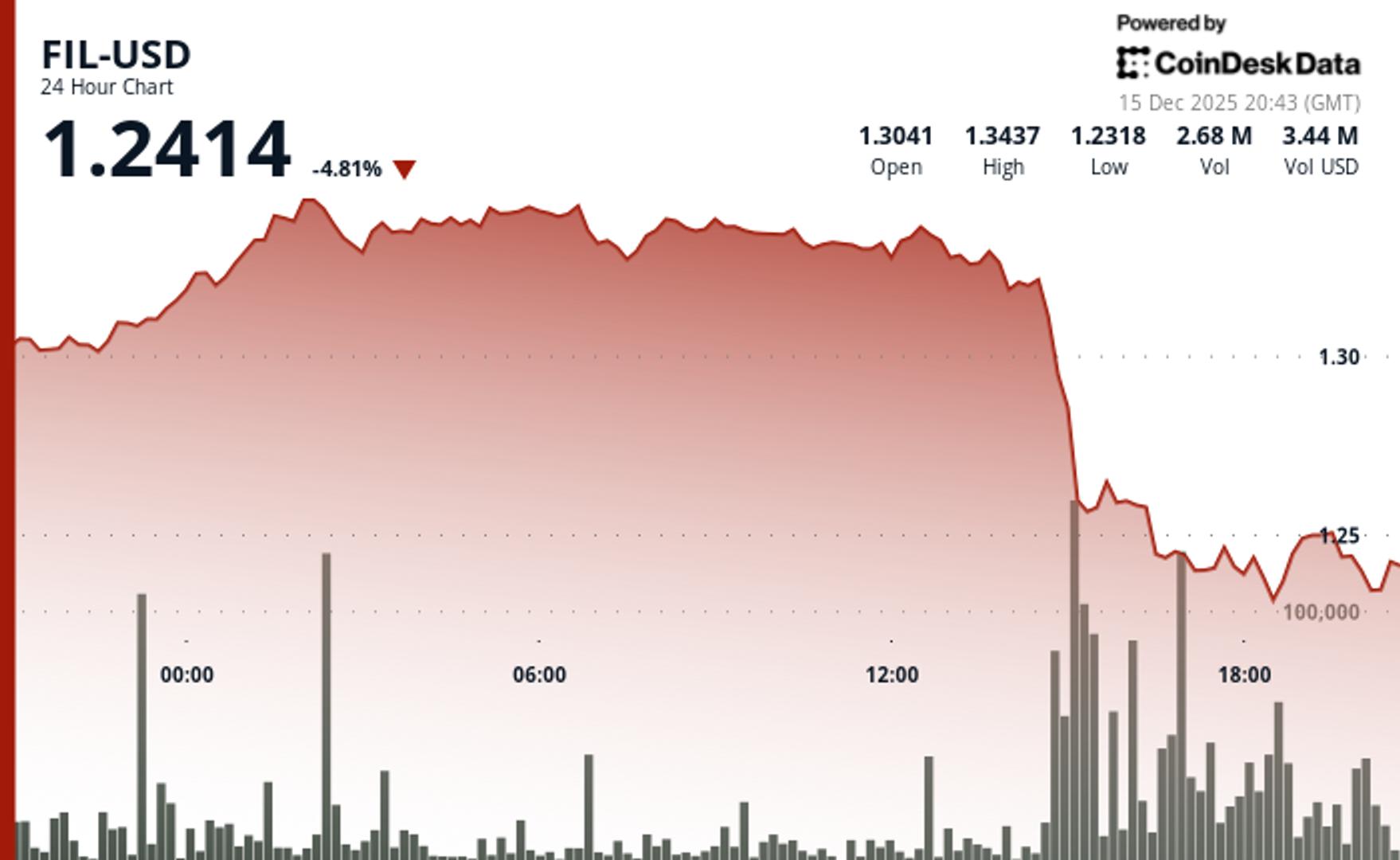

Bitcoin slides to $86,000 as slower rate cut risk, AI stock woes shake markets

NegativeCryptocurrency

- Bitcoin's price has slid to $86,000, significantly below its recent trading range, as concerns over slower rate cuts and issues in the AI stock market weigh heavily on investor sentiment. This decline is part of a broader downturn affecting the cryptocurrency market, with many assets experiencing increased sell pressure.

- The drop in Bitcoin's value is critical as it reflects a loss of confidence among traders, leading to deeper declines in crypto-related stocks and triggering liquidations in long positions. The volatility highlights the risks associated with leveraged trading in the current market environment.

- This situation underscores a growing bearish sentiment in the cryptocurrency sector, exacerbated by external economic factors and fears of an AI bubble impacting both crypto and stock markets. Analysts warn that the interconnectedness of these markets could lead to further declines, as Bitcoin struggles to maintain critical support levels amidst a backdrop of economic uncertainty.

— via World Pulse Now AI Editorial System